State of the Market: Alarm Systems 2012

This year the alarm industry is increasingly unshackled from landlines and high costs, buoyed by end user demand for remote/interactive services, and up against more competition.

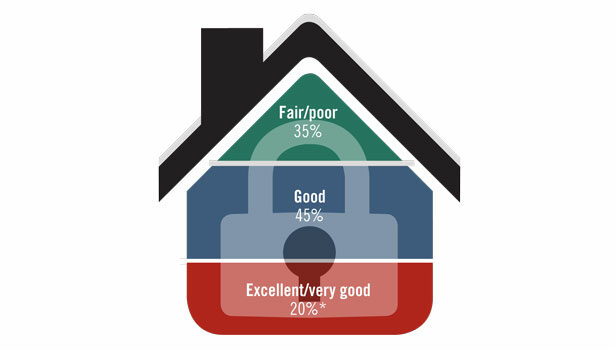

SDM asked dealers and integrators in 2011, "How would you rate the current state of the market in Burglar Alarms?"

*percentage of respondents to SDM's 2012 Industry Forecast Study, conducted October 2011 among SDM's subscribers.

Source: SDM Industry Forecast Study

Almost two-thirds of dealers rated the 2011 market for burglar alarm sales "good" to "very good/excellent."

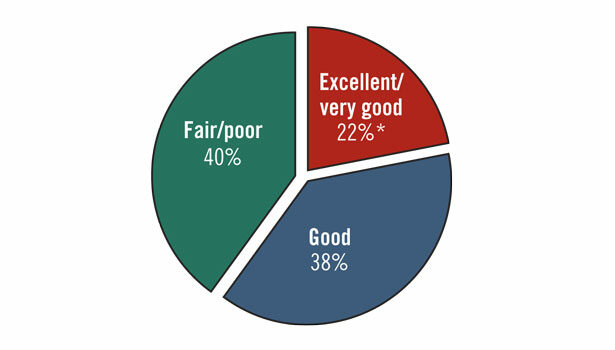

SDM asked dealers and integrators in 2011, âConsidering the economic health of your business, how would you rate the potential for sales in 2012 in the Burglar Alarm market?â

*percentage of respondents to SDMâs 2012 Industry Forecast Study, conducted October 2011 among SDMâs subscribers.

Source: SDM Industry Forecast Study

The overall outlook for alarm system sales in 2012 is good to excellent, note 6 of every 10 security professionals.

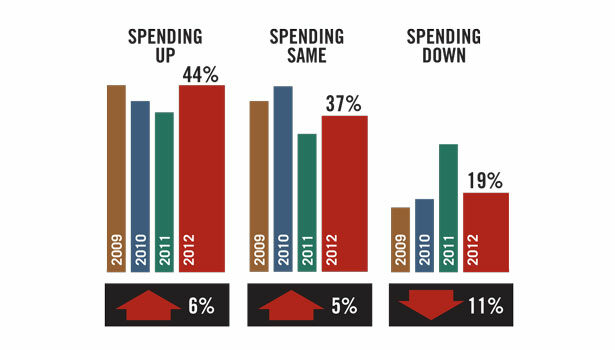

SDM asked dealers and integrators to indicate how they expect their level of spending on burglar alarm equipment in 2012 will compare with prior years.

*percentage of respondents to SDMâs 2012 Industry Forecast Study, conducted October 2011 among SDMâs subscribers. Prior-year figures are based on results of prior Industry Forecast Studies from each respective year shown.

Source: SDM Industry Forecast Study

More than 4 in 10 security dealers indicate their spending will increase this year.

PHOTO COURTESY OF NAPCO

The Fastest Trend in Residential Security

Mobile access is a fast-growing trend in residential security today. Based on the analysis of hundreds of thousands of Alarm.com authorized dealers’ interactive service customers, tracked behavioral changes in usage clearly show this trend. Today, more than 75 percent of remote access events for Alarm.com interactive service accounts are through a mobile app. This is a progression that began in earnest in 2010 and continues to grow with the ubiquity of mobile devices and proliferation of consumer expectations for interactive capability.

Accessing security systems via smartphone is the fastest growing trend, and for dealers and integrators to succeed in the increasingly competitive environment, it’s important to capitalize on this trend. Alarm.com has been providing interactive services to security customers for more than seven years. When the very first Alarm.com app was released in the spring of 2009, the vast majority of logins to an Alarm.com interactive account were through the Alarm.com website. It was a year later that logins averaged 50 percent collectively through mobile apps and 50 percent through the dedicated website. In August 2011, Alarm.com noted the first time mobile app logins reached more than 75 percent, and this has continued to grow.

Mobile access keeps customers “sticky.” In 2011, Alarm.com confirmed the correlation between a consumer’s consistent interaction with their interactive security system and reduced attrition. Through an independent third-party analysis, it was proven that customers with interactive accounts stay on longer than traditional security customers and those who are actively logging into their accounts via the Alarm.com website or mobile app attrite even less. Click here for more from Alarm.com on taking a mobile-first approach.. — Contributed by Alarm.com

Photo Courtesy of Alarm.com

PHOTO COURTESY OF EMC SECURITY

PHOTO COURTESY OF EMC SECURITY

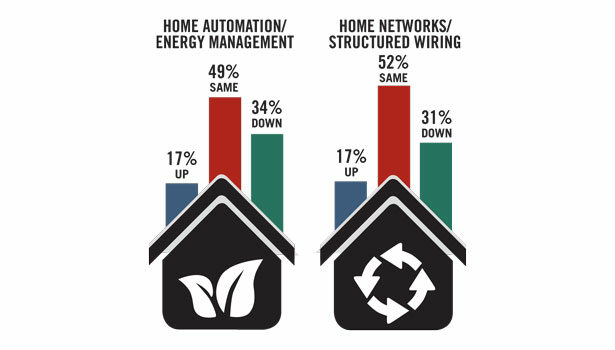

Moderate Growth in Home Products

SDM asked dealers and integrators to indicate how they expect their level of spending on home automation and network equipment in 2012 will compare with prior years.

*percentage of respondents to SDM’s 2012 Industry Forecast Study, conducted October 2011 among SDM’s subscribers. Prior-year figures are based on results of prior Industry Forecast Studies from each respective year shown.

Source: SDM Industry Forecast Study

Spending will most likely stay the same this year in home products according to 5 in 10 dealers.

Enhanced Sensors Open New Markets

“Outdoor detection and asset monitoring offer a great system add-on for dealers. These products continue to mature and improve in reliability with each product life cycle and we are seeing a keen interest in these technologies,” says ADI’s Andy Morra.

New sensor developments keep expanding the outdoor services and asset monitoring dealers can provide. For example, Honeywell’s new 5816OD is ideal for gates, sheds, fences, barns, detached garages or any other outdoor areas in residential or commercial environments.

“There is a need for robust wireless outdoor sensors, especially as end users want to expand their area of influence and awareness. Now dealers can take a look outside and see a long driveway, shed or a gate and can now ask if end users want it monitored,” says Honeywell’s Gordon Hope.

In addition to outdoor sensors, new sensors like Honeywell’s 5870API Wireless Asset Protection Sensor enhance the way dealers can guard against theft in both residential and commercial applications by affixing to virtually any valuable requiring protection within a home or business. This sensor is ideal for environments where the use of a constantly armed panel is not practical — such as colleges, hotels and any areas requiring free-flowing human traffic.

Honeywell’s 5816OD Outdoor Wireless Magnetic Contact

PHOTO COURTESY OF HONEYWELL

Don't Sweat the Small Stuff

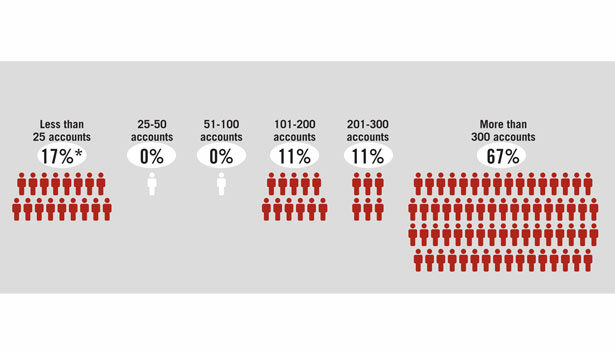

SDM asked dealers and integrators: "Approximately how many subscriber accounts did you acquire from the security-installing/systems integrations companies purchased in the past 12 months?

*average number of accounts acquired per acquisition among respondents participating in SDM's 2012 Industry Forecast Study, conducted October 2011 among SDM's subscribers.

Source: SDM Industry Forecast Study

One in 10 companies were part of an acquisition in 2011. Companies eyed bigger account numbers per acquisition, staying at more than 300 accounts per acquisition almost 70 percent of the time.

Every new year always starts off with speculation. The interpretation of several noticeable changes impacting the alarm industry in 2012 depends on whether one subscribes to the philosophy of “glass half empty” or “glass half full.” What do you think as you read through the following list?

|

Every year SDM gets to talk to dealers, installers, distributors, manufacturers and analysts regarding the state of the alarm market. The conversation in 2012 reveals an industry that continues to adjust to these noticeable changes and many others, as well. While all of the changes have several sides to them, for the most part, predictors see the glass as “half full.”

Mobile Connectivity

Mobile connectivity and remote access remain huge drivers for 2012 growth. Parks Associates recently previewed yet-to-be released research from “The Next Service Provider Race: IP Monitoring, Access, and Controls” for SDM of what U.S. broadband consumers want in remote access. Home security and monitoring service ranked on top as “most appealing,” beating out energy management and control.

According to Parks Associates’ previous research on the appeal of remote home monitoring: 32 percent expressed interest in home automation and control and 28 percent of consumers expressed an interest in home security.

“The alarm industry is poised to capitalize as new technology becomes available and users seek more sophisticated solutions. End users are seeking more from their security system, and integrated solutions are providing positive results for dealers. Consumers have become more tech savvy and are interested in add-on solutions like wireless capability, remote access and video verification that integrate with smartphones and handheld devices,” says Andy Morra, vice president, marketing at ADI, Melville, N.Y.

Home services, including home automation, and remote access are perpetually spurred on by the non-stop growth of smartphones and apps.

Industry research firm Berg Insight predicts global revenues from shipments of home automation systems will grow from $2.3 billion in 2010 to $9.5 billion in 2015. More importantly, Berg Insight forecasts the number of cellular connections used for home automation also will surge, increasing from 0.25 million in 2010 to 5.5 million in 2015.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!