In many ways, Guardian Protection Services of Pittsburgh, Pa., fits the new profile of security company – one that is embossed by the results of SDM’s 2005 Industry Forecast study.

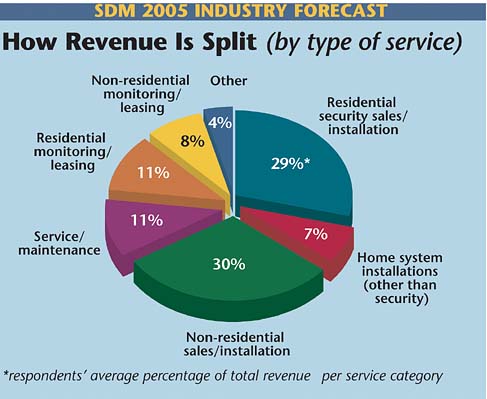

This new dealer has a tighter focus on either the residential or the non-residential market. While approximately 30 percent of respondents to the study consider themselves generalists who serve both market sectors, the vast majority serve either one or the other – 38 percent predominantly sell to residential and 31 percent to non-residential. This fact is confirmed by SDM’s 24th annual Industry Forecast study, which was mailed to 2,000 subscribers.

Colosimo explains that the retrofit market for alarms has been tougher since telemarketing laws came into effect, particularly the National Do Not Call Registry.

“At one time telemarketing was 30 percent of [our] business,†Colosimo notes. Although referrals and other sales methods still account for about half of the company’s residential volume, Guardian has replaced business that previously had come through telemarketing with business from new construction.

“A significant portion of our growth is in the new residential construction market,†Colosimo says. “Given the continuance of a relatively stable interest rate – and the economy seems to be recovering (although modestly) – I believe we’ll experience double-digit growth in 2005 as we did in 2004.â€

In its place, more survey respondents in 2005 than in 2004 cited crime, sales/marketing efforts, disposable consumer income, and residential building activity as major factors to affect sales this year.

“Disposable income and residential building activity really tie together,†Colosimo says. “What I’m seeing a lot of in the new construction industry is the homes for the 55 and older community, and they have a lot of disposable income, which leads to much larger sales.â€

Like Guardian Protection, other security dealers may be facing similar challenges related to sales and marketing. In addition to telemarketing restrictions, companies may be challenged to make more sales with fewer people. In addition, some think the market for stand-alone security systems may be reaching “saturation.†Nationwide penetration of alarm systems is 21 percent of U.S. households.

“We talk to the builders and they say even in the worst time, their market doesn’t fluctuate more than 15 percent,†Colosimo says. “It’s possible that something bad could happen and it would decrease; still, people are building new homes all the time. We believe as long as the interest rate stays stable, we should not see much decrease in the installation volume in the new construction program. They’re building tens of thousands of homes across the country every month, and we’re only looking for some portion of that.â€

Guardian Protection’s home services include structured wiring, security, home audio systems, whole-house vacuum, intercom, and video plasma TVs – a variety of technologies that provide both security and entertainment. The company works mainly with production builders who are constructing homes valued between $250,000 and $750,000, Colosimo says.

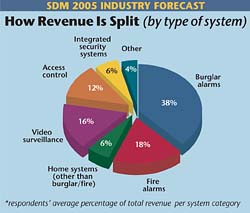

Where dealers and integrators estimate they will spend at least 20 percent more on equipment in 2005 is in home entertainment products, selected by 25 percent of respondents. Video surveillance equipment followed as a close second, with 23 percent of respondents indicating they will spend at least 20 percent more on such equipment in 2005. Only 15 percent of respondents stated they will spend at least 20 percent more on burglar alarm equipment this year. But for some companies, such as Guardian Protection, that figure is low.

The company already operates in 17 markets, and plans to open operations in Phoenix, Ariz., and Charlotte, N.C. in the first quarter of this year. “All the new markets we’re opening up are based on growth prospects in the new construction industry,†Colosimo notes, adding that sales revenue strictly from Guardian Home Technologies is expected to double next year, reaching $35 million. “It’s a whole different business now,†he adds.

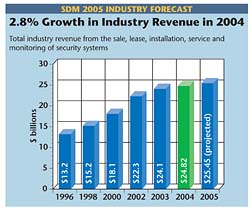

But for the industry as a whole, 2004 revenue growth was more moderate, according to the SDM 2005 Industry Forecast study. Total revenue grew 2.8 percent in 2004 to $24.82 billion industrywide. In order to calculate this figure, Forecast survey respondents are asked to state their company’s revenue from the sale, lease, installation, service, and monitoring of security systems, including alarms, access control, video surveillance, life-safety, home systems, and related low-voltage systems. Respondents’ answers are then projected for the industry, based on representative unit counts of various-sized companies in the security industry.

The Horizon

Two-thirds of survey respondents expect their 2005 annual revenue will increase over 2004, slightly less than one-third expect no change, and just under 3 percent anticipate a decline. Based on the percentage of increase or decrease respondents expect in their annual revenue this year, SDM projects total industry revenue to expand 2.5 percent to $25.45 billion in 2005.Where will new growth come from? Dealers and integrators are fairly evenly split between the residential market (45 percent of respondents) and non-residential market (55 percent of respondents) when asked to name the one segment that will produce the highest rate of growth in 2005. More specifically in non-residential, the most anticipated areas for growth are retail, industrial/manufacturing, and government markets.

Hence, the expansion of services such as remote video monitoring, which can be a useful tool for business managers, is indicated by SDM’s Forecast study. Nearly three of 10 survey respondents (29 percent) now offer such services, according to the study. This figure has increased three percentage points in one year. While there are significant variations in how such services are offered – for example, alarm verification, remote guard tours, and more – the industry has reported a median price of $50 for monitoring.

Networking skills will play a critical role in the future of a firm that specializes in video surveillance and access controls, as evidenced by SDM’s Forecast study. In the product categories of video surveillance, access control, networking/communications, and integrated systems, greater than 95 percent of survey respondents expect to increase their equipment spending in 2005.

Helps & Challenges

On the residential side, authorized dealer programs operated by a variety of organizations are helping provide dealers with the tools needed to close more sales and expand into new markets. More than four out of 10 (44 percent) of SDM’s subscribers belong to one or more dealer programs. However, this is fewer than in 2004, when 50 percent of dealers were involved in an authorized dealer program. Restructuring of some of the major programs in the industry clearly has had an impact.

How much revenue will be determined in large part by a stable economy and their ability to compete with creative products and services.