While several companies have long made PERS equipment, the convergence of market factors has brought household names such as GE and ADT into the game, bringing greater brand awareness and significant R&D spending to the table.

The wave of consumers who will come of PERS age in the next two decades is enormous. Persons aged 65 and older numbered 35 million, or 12.4 percent of the population, in the year 2000, according to the U.S. Department of Health and Human Services. More importantly, between 1990 and 2000 the number of Americans aged 45-64 – the ones who will turn 65 over the next 20 years and constitute the primary PERS market – grew by 34 percent while enjoying an increase in average life expectancy at 65 of 17.9 years. At current mortality rates, there’s a net increase of 650 new older Americans per day.

Along with the growing number of elderly persons is the parallel growth of the home healthcare industry, driven by long-trending increases in medical costs that necessitate shorter hospital stays and long recuperation times at home. According to Curt Quady, president and CEO of Criticom International Inc., which has more than 50,000 two-way accounts, a constellation of factors points to excellent prospects for PERS and good news for alarm dealers.

“The average security dealer has a significant tail wind in conjunction with federal and state government in finding efficient solutions to bring medicine to people through electronics,†Quady says. “The security dealer has a wonderful opportunity to get involved in the PERS market and for very sound reasons. The industry used to be based on burg and fire and will be for a long time, but as an aid to the stability of an alarm company, PERS is an excellent addition.â€

The Indirect Sale

The differences in customer need between PERS and security results in a different kind of sale, meaning that the typical PERS sale is indirect – to a service provider, a spouse, or an adult child of an older person living independently but in need of monitoring. In some cases, the person monitored by the PERS system may not particularly want it – the decision is made by a family member or other caregiver who wants the reassurance and convenience that the system provides.“We don’t market to the end user,†reports Brian Schmidt, director of sales for Schmidt Security Pro in Mansfield, Ohio. “Our PERS specialist calls on persons who recognize the need for our services, such as doctors’ offices, hospitals and social workers.â€

David Tyler, owner of Safer Independent Living and parent company Home Safety Systems, echoes the idea: “One of the common misconceptions about the PERS market is that we target elderly persons for our marketing message,†he says. “The reality is that adult children’s demand for convenience and automated response make them the initial decision-maker about the purchase.†With so much to manage already and the additional responsibility for an elderly parent, adult children value the convenience that automated PERS systems can afford them. Adult children along with the older parents benefit from the automation features of typical PERS systems: personal call buttons, two-way voice, pill reminders, no-activity alarms, and automated paging.

All PERS units are designed for do-it-yourself installation. Unlike security, however, PERS do-it-yourself systems are typically installed professionally, and they’re monitored professionally.

Trends in medical technology point to additional growth in the means and ends of monitoring. Quady cites increased sophistication in PERS technology that will monitor “the vital signs as well as the location†of the client, so independent alarm companies that want to transition their value-base into new areas have several good reasons to consider the PERS market.

According to Kevin Chase, director of healthcare monitoring at GE Security, Arden Hills, Minn., the company is taking PERS monitoring to the next level. GE has launched a new Home Assurance Program that combines the wireless sensors and monitoring technology of the GE Personal Emergency Response System with the connectivity of new communication technologies and web-based systems to create innovative solutions for independent living.

“With this new system,†Chase reports, “families and caregivers can help seniors live at home longer by remotely monitoring a variety of functions, daily activities and medication compliance.â€

Alarm companies may choose to grow through home entertainment, networking and other low-voltage home products, but PERS may be even more profitably suited to growth than other technologies. Darren Torrence, president of Valued Relationships Inc. (VRI) in Springboro, Ohio, recently sold the 300 accounts of his security division in order to focus on the more profitable medical monitoring business.

“When we were a small company it might take all day to put in a security system,†Torrence says, “but as we grew into PERS and I saw we could do eight to nine PERS systems in a day, I could see how the recurring could grow.â€

PERS Monitoring Isn’t Security Monitoring

The ratio of installation-to-customer interaction time illustrates a key difference in the mindset and service model of PERS. Because the elderly customers served by PERS businesses require more patience than typical security customers, and because PERS monitors people instead of property, the customer becomes a more personal focal point than in a typical security sales scenario.“It’s not about going out and slamming in 300 systems,†Torrence adds. Although quality equipment and installation are essential, the quality of human services is what PERS installers take to the bank. With a staff of 25, Torrence now monitors 14,000 PERS accounts.

Blane Comeaux is general manager of Acadian On Call, a monitoring and ambulance company serving Louisiana, Mississippi, and other areas. In addition to installing and monitoring their own systems, Acadian On Call serves ambulance service subscribers who know they will make several trips to the hospital due to their medical conditions.

“Our people are SIA certified paramedics that can do self–help over the phone,†Comeaux says. “They go through a regimen of question and answers to find out what kinds of issues a client has. What kinds of pain are they experiencing; is it chest pain, is it radiating? Are there breathing complications? We have an advantage over other monitoring stations in that we are medical in nature.

“Our PERS monitoring business has doubled each year for the last four years,†Comeaux adds.

Russ Peterson, director of central station at CRC Monitoring in Austin, Minn., describes a typical PERS alarm situation as one involving a client who is unable to move and needs assistance. In some cases the operator contacts a neighbor on the call list who can lend assistance. Operators may also call family members for the client and stay on the line until they arrive at the client’s home.

To nurture a personal relationship with clients, Peterson requires clients to activate their systems monthly to establish a comfort level with the central station. “We get them used to talking with us,†he says, “so when there is an alarm they don’t feel like they’re talking to a stranger on the phone.â€

False alarms are limited by the fact that a button has to be pressed for an alarm to be activated. “You’re talking about a verified response in any case,†Peterson says. An accidental alarm won’t involve an ambulance or other agency dispatch. He adds that the vast majority of true alarms are for assistance from a key holder rather than for an ambulance.

According to Peterson, a central station can say it’s equipped to monitor for PERS, but operators may not have the experience it takes to build a successful PERS business. An operator who is responsible for one medical account and 100 security accounts is not used to developing the personalized relationships that PERS requires. Peterson recommends that dealers check with customers of the central station to get a feel for the station’s rapport with clients.

“Get testimonials,†he adds. “PERS customers need to get help and feel good about getting help. Feeling good about the help is what a customer’s satisfaction is going to be based on.â€

Sidebar 1

What to Look for in a PERS Monitoring Station

Christopher Baskin, CEO of American Two-Way, North Hollywood, Calif., asserts that a dealer considering the PERS market should insist on true two-way voice monitoring, so that when an alarm goes off an operator is in immediate live voice contact with the customer. “True two-way is not call-back mode,†in which the signal is transmitted to the central station, which then calls the remote unit, Baskin emphasizes.“The central station must have medical info come up on the screen along with the signal,†Baskin adds. Typical information designates the preferred hospital, the doctor’s name and other vital medical history.

Finally, Baskin recommends the ability for the central station to cross-patch a third party into a teleconference between client and central station. Loved ones want to be informed of a medical emergency in real time and, along with the operator, are often able to deliver some comfort over the phone until emergency medical workers arrive.

Tony Wilson of CMS in Longwood, Fla., recommends that staff and space be dedicated to PERS. Dedicated staff are needed to meet the needs of the client base of elderly persons. Dedicated space is required in large part due to the noise level on the medical side of the office driven up, because operators must raise their voices to be heard by some hard-of-hearing clients.

Growth in PERS sales means growth in PERS monitoring, and Wilson reports changes in the training regimen he’s starting to see at CMS. “We’re at the volume right now where we can train specifically for the medical side,†he says, “and we have separate management for it. Demand from our dealer base is driving that change.â€

Others may disagree, but Baskin doesn’t think there is any greater

liability for PERS than for burglar or fire alarm monitoring.

“We don’t see and we don’t experience any litigation regarding any accident with PERS monitoring,†he says. “They’re all life-threatening situations and insurance companies see it the same way. We help dealers with limit-of-liability clauses and we’ve never seen it challenged. Almost all insurance companies do not separate it – one policy covers all of it.â€

Sidebar 2

The Language of Home Healthcare Monitoring

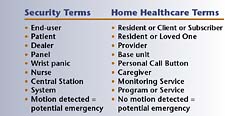

Consumers of home healthcare services differ in expectations from people interested in security. Those differences are reflected in the vocabularies of the two markets, which is an important part of training for sales and technical personnel.Although PERS systems use much of the same technology as burglary systems, the function of sensors for PERS applications is significantly different than the function for security applications. Motion sensors tell the system whether a client has moved around according to his or her daily routines, and trip an alarm when no motion is detected to indicate a possible medical emergency.

Another defining difference between PERS and security is the length of monitoring contracts. Several market-specific factors affect the length of monitoring, including the age and health of the resident, and family lifestyle. As a result, industry averages put the length of monitoring contracts at 12 to 22 months. In most cases a fixed-term contract is a barrier to sales, so contracts operate on an open-ended, month-to-month basis and providers keep their accounts.

David Tyler, owner of Safer Independent Living and parent company Home Safety Systems, identifies an irony of the PERS business:

“The more a customer needs the service, the more likely it’ll be a short-term installation,†he says. “Once someone falls or their medical condition gets worse, they won’t be able to live independently.†So the mindset around monitoring contracts is different from that of a security model, requiring a compensating strategy for relatively short-term monitoring revenues.

Nevertheless, many security-installing companies find that a PERS product offering is a highly valued adjunct to their security services. According to Brian Schmidt, director of sales for Schmidt Security Pro in Mansfield, Ohio, growth in the number of home healthcare products led to the dedication of a full-time salesperson to PERS sales. “We’re excited because GE has indicated they are dedicated to this market,†Schmidt says. “We’re building a PERS customer base because we’ll be able to promote value-added features to that base down the road.â€

Leigh Johnson of Custom Alarm/Custom Communications in Rochester, Minn., reports that he’s in the PERS market to meet community needs. He got started in PERS with a sizeable commercial application. “A couple of years ago we put a large system in an independent living facility. Everybody in that facility has use of a system automatically when they move in.†In addition to larger commercial applications for assisted living complexes, Custom’s sales come from referrals of existing security customers.

Schmidt and a PERS specialist work with local MEDICAID-approved agencies to lease the product to residents. Because installation and service are paid for by MEDICAID, a caseworker gets involved in the reimbursement process.

David Tyler sells through home medical equipment retailers. “It’s a natural fit to offer PERS through a home medical equipment retailer,†he says.

After being in business for less than a year, Tyler counts 50 percent of the home medical equipment retailers in Oregon, Washington, and Idaho as his customers.

Sidebar 3

PERS Business Models

PERS lends itself to three primary business models: the lease, the sale, and the free system.A lease involves base unit installation, a personal call button worn like a watch, and monthly monitoring. The sale or lease of a base unit and personal call button may also include add-ons such as line-grabbers and environmental or motion detection. Darren Torrence, president of Valued Relationships Inc. (VRI) in Springboro, Ohio, leases systems on an open-ended contract to clients for between $30 and $35 per month on systems he leases from the bank for under $5 per month.

Free systems typically feature a do-it-yourself installation with optional professional, fee-based installation, plus an

activation fee to recoup upfront costs.

Short-term lease

• Average monitoring time of 12 to 22 months

• No equipment fee for subscriber

• Some charge a set-up fee of $40 to $75

• Optional installation fee of $50 to $75

• Subscriber returns equipment

Sales and Subscription

• Subscriber pays an equipment fee

• DIY installation or optional professional

installation, with fee

• One- to three-month service fee; no

contract length beyond that

• Average monitoring period is

12 to 22 months

• Subscriber keeps equipment

Free System with Subscription

• No equipment fee

• Some charge an activation fee

• Free installation, DIY installation or optional professional installation ($50 to $75)