The cash cow of the security industry, the source of all recurring monthly revenue (RMR), is the monitoring of fire and intrusion alarms and the equipment sold to do that.

“We are falling in love with the recurring revenue,” declares Wayne Beck, CEO of A-Com Protection Services Inc., Columbus, Ga. “If we’re going to stay in business, we’re going to learn that recurring revenue is only good if it’s at a controlled cost. We’ve had to do a paradigm shift. Believe it or not, we make money on residential now. If we don’t, we can’t stay in business.”

Beck has added some equipment to his burglar alarm package and raised his basic system price an additional $400, but he dropped his monitoring price by $10, which included a $2 price drop and elimination of an $8 monthly service fee. The strategy increased his business 20 percent.

“We felt like we should show a customer that if they were going to buy a system from [a competitor] and pay less upfront for the system but more for the monitoring, that if they bought a system from us, in the long run their monitoring would be lower — so it was a marketing philosophy,” Beck explains.

Ronald Petrarca, director of operations, license and compliance administrator for Electronix Systems C.S.A. Inc., Huntington Station, N.Y., thinks some of the monitoring industry’s price sensitivity is self-inflicted. “Competition negatively influenced the industry because of the ‘basic’ residential package offerings and zero-down systems that have created the perception of alarms having little cost and value,” he declares.

Thomas Patterson, chairman/CEO of Kimberlite Corp., Fresno, Calif., reports good sales. “We’ve been on a tear for the past three years, with 25 percent year-over-year increases in sales,” he notes. “Now, a portion of the recent increase comes from video surveillance, which is very hot right now, but burg sales look good, too.

“A continued shift toward video would have a negative impact on our margins, as there’s too much competition in that market segment — it’s hard to compete with the Internet,” he concedes.

Patterson is bullish on the fire alarm business. “There are tremendous opportunities in fire for those companies that take the trouble to build a team of professionals to service the market,” he maintains. “Construction is still strong in the commercial market, and the old-line players are going through some turmoil, so that’s good for us.

“We have built a separate fire services division in the past few years, populated by fire professionals, so we’re in a good position to capture some of the business,” Patterson stresses.

John Doyle Jr., CEO of Doyle Security Systems Inc., Rochester, N.Y., reports a 15-percent increase in burglar alarm sales over last year. He cites customers who are traveling more and leaving their primary homes empty or who own vacation or second homes that are empty.

Drew Chernoy, finance and business development, Scarsdale Security Systems Inc., Scarsdale, N.Y., points out that verification requirements have increased his company’s business. But he admits his company does not see price-sensitive clients very often.

“If a customer wants a free system, they will find someone to install it,” he asserts. “Our core business is from regional customers who are referred by a contented client. These customers receive a good value for their investment and are appreciative of our attentive service and support.”

The company’s participation in the reality television series “It Takes a Thief” on the Discovery Channel has aided the company’s marketing efforts. “This little bit of exposure seems to matter,” he declares.

Wayne Wahrsager, president of New York Merchants Protective Co. Inc., Freeport, N.Y., attributes his approximately 30-percent increase in fire alarm sales to municipalities starting to enforce the regulations that have already been on the books and requiring more detailed work to be done.

“The systems that are being required now are a little more extensive in their scope than in past years,” Wahrsager reports. “Municipalities are becoming more conscious of what new locations need and are requiring it to a higher degree.”

MANUFACTURERS SHOW OPTIMISM

Those who sell, distribute and monitor fire and burglar alarm systems also are mostly optimistic about the industry’s prospects in 2007.“The residential and commercial fire alarm markets are poised for solid growth,” reports Richard Roberts, senior product manager for the security business unit of System Sensor, St. Charles, Ill. “That is due to the regulation — fire alarm codes and standards.”

Additionally, product innovation is contributing to growth at his company, a worldwide manufacturer of fire notification appliances and peripherals. “We’re constantly introducing new products and enhancing existing products,” Roberts insists. “That really is the lifeblood of our company.”

Roberts forecasts sales growth in 2007 in the high single digits for the fire alarm market. “That trend has continued over the last two or three years,” he says of those sales increases.

Also feeling optimistic about 2007 is Rick Falbo, national sales manager for Summit System Technologies Inc., Toronto. “We still feel that 2007 is going to be a strong year, based on what forecasting we have done internally,” Falbo predicts. “We think the economy in most areas is still firm both in new construction and in the retrofit markets.

“There are pockets of real strength across the country,” he insists. “Other areas that are not superstrong still seem to be holding relatively firm. When you consolidate all those forecasts, it bodes well for a strong year.”

Bill Jackson, president of Digital Monitoring Products Inc. (DMP), Springfield, Mo., reports double-digit unit sales increases, especially in wireless and the higher-end networked addressable control panels.

Reporting more moderate growth is Jim Paulson, product general manager for the intrusion group of GE Security, Bradenton, Fla.

“In general, the market is fair but competitive,” Paulson says. “There’s a lot of effort on the part of everybody to compete for the same piece of pie.

“The manufacturers have not developed market expansion products or business propositions that are putting us on a growth mode,” Paulson declares. “The real question is, how do we break through? GE Security is looking for ways to expand the pie for us and our customers, and that’s harder.”

Central stations are reporting solid growth in monitoring business and expecting more in 2007.

“We are finding that the better dealers with a good business plan and adequate capital are growing very handsomely in this industry as they have historically over the last five years,” reports Russell MacDonnell, chairman of Rapid Response, Syracuse, N.Y. “I do think this is one of the better years of the last five years from our perspective.”

At distributor ADI, Melville, N.Y., Scott Sturgess, director of product marketing for intrusion and fire products, is reporting record growth. “In 2006, we had a record year for both intrusion and fire at ADI,” he asserts. “The last 24 months we’ve just been having very strong sales numbers.”

But a strong start in January of this year is not necessarily an indicator of future performance, Sturgess cautions. “It’s tough to say what’s going to happen in April,” he concedes. “The intrusion and fire market is seasonal. Typically, we really see a big upswing from April through September or October, so we’re anxious to see if that’s going to happen again this year.”

He is similarly cautious about the intrusion market, although he thinks the fire alarm side of the distribution business will be good, because commercial building and spending is still strong.

“On the intrusion side, my outlook is a little less optimistic, because of the housing starts that have declined pretty significantly,” he warns. “There’s some challenges in the housing market that are going to impact the intrusion business in the U.S.”

COMPETITION

Beck thinks competition from burglar alarm companies is about the same as it has been in previous years. “We’re seeing more electrical companies wanting to get into the business,” he reports. “I also own a telephone company, and we’re kind of an integrator in that. I see the VARs competing with me on that side of the business, but not so much on the burglar alarm side.”Petrarca agrees that competition is coming from companies not even in the security business. “Audio companies are doing alarms now as well as network and phone companies,” he complains. “We’ve had oil companies in the mix for years.”

Doyle faces a problem with finding qualified subcontractors in his markets. “This has increased the cost or the wait time for customers in many cases,” he notes.

Beck is trying to improve customer service, too. “We’re going to give the customer the service they want, not the service we think they want,” he insists. “A lot of people think they’re giving good service, but they have so many roadblocks that they’re not.

“I’ve been in business 34 years, and I still have people calling me to complain,” he maintains. “My name and number are in the directory for that reason. If a customer doesn’t get satisfaction and they’re upset, it’s best for me to know about it. If you’re the first one to talk to a customer, it’s your responsibility to make sure they’re taken care of properly.”

One of Patterson’s concerns is staffing his central station. “Our central station in Fresno, Calif., assisted local police in apprehending 552 criminals in the act of burglarizing and/or vandalizing our customers’ premises in 2006,” he declares. “In 2005, we caught 576. We only have around 6,900 alarm systems in service.

“We couldn’t be more proud of our central station, and believe it to be at the core of our success,” he asserts. “So, as you can imagine, we’re continually hiring, training and developing staff, so as to maintain apprehensions while driving a higher quality customer interaction. It’s always a struggle, but I’m fortunate to have a first-rate team running — and staffing — our central station.”

WHAT PRODUCTS ARE PROFITABLE?

Roberts cites a strong regulatory environment mandating the installation of residential and commercial fire alarm and carbon monoxide detection systems as one of the reasons that his company anticipates growth.“We view that as a burgeoning market,” he says of CO detectors because of increasing legislation in recent years requiring their use. Other products growing in sales include addressable and wireless smoke detectors, he notes.

“They’re experiencing high teens in terms of percent growth, whereas conventional hardwired smoke detectors are relatively flat,” he declares. “You get more functionality out of wireless and addressable smoke detectors than you do with hardwired detector systems.”

The company for which Falbo works, Summit System Technologies, was launched in January 2006 by Mircom Technologies Ltd., Vaughan, Ontario, its parent company, which has seen an increase in the sale of addressable fire alarm panels.

“We are seeing a trend toward installers preferring to run a new addressable signal line circuit in place of the existing wiring and using an addressable system in large to small projects and retrofit ones as well,” Falbo stresses. “A lot of jurisdictions are becoming more adamant in demands for addressability. It is a lot more user-friendly, especially in emergency situations.”

Paulson is similarly fired up. “For us, the fire category is growing at double-digit rates, which is three times the market rate, because of our channel partners and our product platforms,” he notes. “In addition, our security intrusion alarm systems are growing at upper single digit rates.”

“Our fire channel grew a bit more than our security dealer channel, so I’d say the engineered systems integration channel grew a little bit more than double digits versus the security dealer channel, which grew in upper single digits,” Paulson continues.

Profitability also was good for his company, but Paulson thinks maintaining it is an issue. “We need to continue to invest in new product development and look for opportunities to create a unique value proposition or service that doesn’t exist today, and we’re working on several of those,” he relates.

He is aware of the problems some dealers and integrators are having. “Some can’t grow because they can’t get enough installers,” Paulson points out. “We have to look at new ways to allow labor savings and allow dealers to install more with the same number of people, like wireless.”

Newer products from Napco Security Group, Amityville, N.Y., are simplifying installation. “Sales of older-line, hardwire-only systems have seemingly been slowly eroded and replaced by newer, easier-to-install hybrids, which require less skilled labor,” reports Judy Jones, vice president of marketing. “Labor-shortages dealer-side have brought about this change, and we’ve responded and kept in step with their changing work force.”

ISSUES IN THE INDUSTRY

Jackson sees opportunities in several vertical markets. “The financial institutions continue to be very attracted to our product because of the ability for them to operate in a networked environment,” he notes. “The retail segment is also one that continues to look very promising and is growing every year for us. The federal government has a lot of opportunities, and we have product panels that are specially designed to be compliant with government requirements.”Growth of wireless technologies is among the trends that Rod Garner, president of Mountain Alarm, Ogden, Utah, sees.

“The success of summer marketing programs is changing the way capital looks at the industry,” he asserts. “Attrition metrics and sustainable positive results will tell the complete story on this model. As an old schooler, I believe attrition will come back to bite this model in the butt, and smart money will seek quality operators that can achieve a balance of growth with good metrics, such as attrition.”

Attrition is rivaling new sales at Electronix Systems, reports Petrarca. He sees VoIP usage as a continuing trend and challenge.

“Less people are installing copper phone lines,” he points out, but adds that with the phasing out of analog cellular monitoring services, “Radio and Internet monitoring sales are good.”

Wahrsager has been proactive with issues relating to the AMPS Sunset Clause issue and VoIP.

“It interferes quite a bit with the transmission of signals,” Wahrsager says of VoIP. “Whatever we do to educate the consumer, it doesn’t always happen that way. They put VoIP in without telling us about it. With VoIP, it takes more time than the traditional service call to reconfigure that, so that’s having an effect on our company.”

Melissa Brinkman, director of customer services for Custom Alarm, Rochester, Minn., sees a huge surge of homeowners switching their traditional land lines to Internet or cable, but sees a downside.

“There is a great push for a lot of homes to be automated and have an all-in-one solution, especially in new homes,” she notes. “This isn’t necessarily the best solution for an alarm system. This is frequently overlooked in the excitement that a homeowner has to bundle his/her services. I would recommend that a homeowner be more wary of ‘putting all their eggs in one basket.’”

THE FUTURE

New products are creating new markets for Doyle. “Consumers are also interested in our ability to protect their home with environmental products like water-bugs, carbon monoxide monitors and temperature sensors,” he points out.Beck is optimistic about the industry. “I think the future is good,” he predicts. “We have to make sure that the professionalism of it is maintained and even improved — that we stay focused on what is important to the customer. We get too wrapped up in what we think we need to sell and not on what they want to buy.”

Sidebar: Medical Monitoring to Increase

A growth opportunity in the monitoring market that Scott Sturgess, director of product marketing for intrusion and fire products for ADI, Melville, N.Y., is optimistic about is personal emergency response (PERS) systems.“I think one of the technologies that is a little ahead of its time that we’ve been trying to create a market for is personal emergency response (PERS),” Sturgess reveals. “We see that as a big growth opportunity in the upcoming years.

“A lot of our dealers are selling PERS because it’s a quick, wireless install, and the RMR revenue is higher than for a typical burglar or intrusion system,” he declares. “So even if dealers just work their existing client base, they can really market this PERS product to the elderly. With the graying of America, it’s a great opportunity for our dealers to get into the PERS business.”

Wayne Wahrsager, president of New York Merchants Protective Co. Inc., Freeport, N.Y., agrees about the importance of PERS. “The empty nest and Social Security group will want to stay in their home, and PERS monitoring will become a very large piece of business,” he maintains.

Sturgess also reports “tremendous growth” in digital cellular GSM radio systems for backup because analog systems are due to be phased out in February 2008.

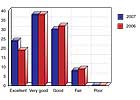

Sidebar: Confidence Controls the Market

SDMasked dealers and integrators, “Considering the economic health of your business, how would you define the state of the market and the potential for burglar and fire alarm sales in 2007?”*percentage of respondents toSDM’s 2007 Industry Forecast, conducted November 2006 amongSDM’s subscribers

†percentage of respondents toSDM’s 2006 Industry Forecast, conducted November 2005 amongSDM’s subscribers

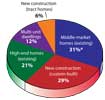

Sidebar: Hottest Vertical: Middle-market Homes

SDMasked dealers and integrators, “In which one residential market segment do you expect to see the highest rate of revenue growth for your company in 2007?”*percentage of respondents toSDM’s 2007 Industry Forecast, conducted November 2006 amongSDM’s subscribers

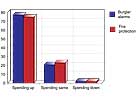

Sidebar: Installers to Spend More in 2007 on Alarms

SDMasked dealers and integrators to indicate how they expect their level of spending on burglar and fire alarm systems in 2007 will compare with 2006.*percentage of respondents toSDM’s 2007 Industry Forecast, conducted November 2006 amongSDM’s subscribers