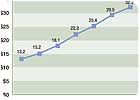

Industry Grew 9 Percent in 2006; Can 2007 Repeat?

Total industry revenue from the sale, lease, installation, service, and monitoring of security systems

Total industry revenue ($ billions)

Total annual industry revenue collected through security dealers and systems integrators in 2006 improved 9.3 percent to $29.5 billion. Forecast survey respondents are asked to state their company’s revenue from the sale, lease, installation, service, and monitoring of security systems, including alarms, access control, video surveillance, life safety, home systems, and related low-voltage systems. Respondents expect 2007 to repeat at 9 percent growth to $32.3 billion.

Total industry revenue from the sale, lease, installation, service, and monitoring of security systems

Total industry revenue ($ billions)

Total annual industry revenue collected through security dealers and systems integrators in 2006 improved 9.3 percent to $29.5 billion. Forecast survey respondents are asked to state their company’s revenue from the sale, lease, installation, service, and monitoring of security systems, including alarms, access control, video surveillance, life safety, home systems, and related low-voltage systems. Respondents expect 2007 to repeat at 9 percent growth to $32.3 billion.

The U.S. market for security products and services was very strong in 2006, and that potency is expected to carry over into 2007, as well. While radical changes in technology continue to demand attention from the industry and its customers, security dealers and systems integrators are stepping to the beat of today’s market while simultaneously gearing up for the next wave of detection/prevention technology and its resultant change on business operations.

Total industry revenues pointed upwards of $29 billion in 2006, more than 9 percent greater than 2005 revenues, according to SDM’s Industry Forecast Study of security dealers and systems integrators. In order to calculate this figure, survey respondents were asked to state their company’s revenue from the sale, lease, installation, service, and monitoring of security systems, including alarms, access control, video surveillance, life-safety, home systems, and related low-voltage systems. Respondents’ answers are then projected for the entire industry, based on representative unit counts of various-sized companies. SDM’s Industry Forecast Study – the results of which are presented in this article – has been conducted annually since 1981.

Compared with other industries, security’s 9 percent growth rate is exceptional — right on target with what survey respondents projected for 2006 — and both residential and non-residential market sectors appeared healthy. Revenue from video surveillance and access control systems was steady; together, these two categories comprised slightly more than one-fourth of installers’ total revenue, as it did in 2005. Both the burglar and fire alarm markets improved slightly as a percentage of installers’ total revenue, comprising an average of 58 percent of an installing company’s revenue.

Dissecting total industry revenue by service type reveals that the lion’s share — 65 percent — came from sales and installation services. On the residential side, that share edged up slightly in 2006, while it decreased slightly on the non-residential side. There are several factors at play here: first, equipment prices — especially cameras and digital video recording systems — have dropped radically as a disproportionate number of vendors competes for their piece of the security pie; second, dealers and integrators have reported to SDM that end users are becoming more demanding in both the value they expect and the price they are willing to pay, knowing they can turn to any number of sources, including the Internet, to purchase a security “solution.”

The average price for a new residential alarm improved about 2 percent – from $1,645 to $1,683 – for a traditional, custom-designed system. However, the average price for a new security system in the non-residential market declined nearly $200 – from $4,594 to $4,407. Nearly 7 in 10 respondents expect prices in this market to stay about the same in 2007.

Hottest Vertical Market: Middle-market Homes

Dealers and integrators indicate the one residential market sector where they expect the highest rate of growth for their companies in 2007.

*percentage of dealers and integrators indicating each market

(Note: comparable data not available for prior years.)

In the residential market, existing homes pose the best potential for security sales in 2007. It is the most untapped market for security systems, according to SDM’s research.

Dealers and integrators indicate the one residential market sector where they expect the highest rate of growth for their companies in 2007.

*percentage of dealers and integrators indicating each market

(Note: comparable data not available for prior years.)

In the residential market, existing homes pose the best potential for security sales in 2007. It is the most untapped market for security systems, according to SDM’s research.

In the residential market, the top three best-growth markets are: existing middle-market homes, custom-built new construction, and existing high-end homes. So while the target for residential dealers is more customization and higher system prices; the target for non- residential is mid-level commercial, retail, etc.

The survey confirms that video surveillance systems are finding greater acceptance — in fact, even standardization — among smaller commercial and retail establishments. When asked about which types of products they will spend more, less, or about the same amount on in 2007 compared with 2006, dealers and integrators indicated that the top three product categories in which they will spend more money are: video surveillance/CCTV, IP network-based video equipment, and monitoring equipment such as Internet, RF, and cellular. SDM has recently reported on the need for security companies to upgrade cellular-based radio alarm communicators due to a mandated shift to digital technology by February 2008.

Even with their challenges — such as justifying the price of a professionally installed video surveillance system when cheap cameras and DVRs are rampant on the Internet – dealers and integrators plan to focus on selling value-added solutions by, as one example, sharpening their network skills. SDM’s Industry Forecast Survey asked, “What percentage of new installations or projects does your company use your expertise in information technology/networks?” Respondents indicated that 59 percent of new projects involves IT/network technology. Feeding into this requirement is the need for designers and technicians with experience beyond keypads and motion detectors. Finding and retaining employees will be the single greatest challenge that security companies face this year, as 19 percent of all respondents indicated (up from 12 percent just two years ago).

Many in the industry believe that to effectively compete in security by next year, dealers and integrators must have network-certified technicians on staff. SDM’s subscribers recognize the importance of the economy on their business. Perhaps because of the latest news suggesting that the economy may slow this year, survey respondents related that the single greatest factor they believe will have the most impact on sales in 2007 is the economy, followed closely by crime.

Part of the beauty in the security industry is that its participants — security dealers and systems integrators — have shown over time that they are capable of adapting to both changes in technology and in the marketplace. With all of the various positive and negative influences upon them, they remain optimistic in their outlook for 2007, particularly in two segments — video surveillance and burglar/fire alarms. (See related story in this issue, “Video Surveillance: State of the Market,” on page 46.) This will be a telling year for traditional companies that resist change.