Lower prices are driving sales of video surveillance systems, especially DVRs and cameras, reported many of the security dealers, systems integrators, equipment manufacturers and distributors interviewed for SDM’s second annual state of the market report on video surveillance. Sales of equipment for some manufacturers are doubling from year to year. But some dealers and integrators are conceding that as prices drop, so do their margins.

Most security professionals that SDM spoke with agreed that IT products will be part of the future, but most added that they are not achieving high market penetration yet.

“We’re just smoking busy,” maintains Marty McMillan, president of Intelli-Tec Security Services LLC, Westbury, N.Y. “It’s a good thing. We’re probably up about 20 percent this year over last in video, maybe even 30 percent.”

Tim Walsh, vice president of BCI Technologies, Grand Prairie, Texas, estimates sales of video surveillance systems at his company have increased approximately 20 percent over the last 24 months and 10 percent in 2006.

“The potential for business is still there,” Walsh maintains. “The CCTV business since 2001 has been on a solid increase for BCI and for the industry. You see a lot more call for high-end CCTV systems or systems that are larger than they would be.”

The need for video surveillance appears to be all-encompassing, thinks Shandon Harbour, general manager of SDA Security, San Diego.

“The only thing I see happening is definitely increasing the video,” she declares. “That is going to be a method for revenue this year, and next year, and the following year. People are calling, ‘I want cameras.’”

Clifford Franklin, president of Sabre Integrated Security Systems, New York, characterizes the video surveillance market as fair. “I wouldn’t say it was great,” he replies.

“We’ve done a lot more new projects this year, up to 30 new projects on video surveillance alone for 2006, but the jobs are much smaller,” he laments. In the past, his average job size was $15,000, but now he is doing more $10,000 jobs.

“We haven’t had so much work on enterprise-class DVRs this year,” Franklin says. “We’ve been extending the systems we’ve put in, but we haven’t had any new enterprise class systems this year.”

The number of jobs from small businesses is increasing, says Jason Gonzalez, CEO of Visual Management Holding System (VMS) Inc., Toms River, N.J. “I think that there is a substantially larger appetite for surveillance in small business than ever before, and I think it’s growing constantly,” he declares.

Kurt Will, vice president of Will Electronics Inc., St. Louis, finds just the opposite. “Probably the number of projects is down, but the size of the projects is up,” he reports. “What we’re finding is that we’re not doing as many of a lot of the smaller projects, because there’s a lot more competition out there at the low end of the market. There are a lot of the Johnny-come-latelies in the surveillance business, and a lot of the smaller jobs they’re gobbling up.

“The jobs that require more technical expertise for veterans who have been around a while, tend to be larger jobs,” Will explains, adding that his company has been in the security business for more than 30 years.

These larger video surveillance jobs his company is obtaining do not have a unifying characteristic other than their size, Will describes. “Camera costs have gone down significantly, so we’re seeing camera counts up on all types of jobs, but the integration and the network are definitely making these jobs more complex,” he notes.

END USER SOPHISTICATION

Harbour thinks end users are more sophisticated due to their research of security products on the Internet. Some even will specify the type of lens and video storage they want, she reports.Adds Dan Tick, SDA Security’s central station/technology manager, “People have become accustomed to video being delivered to the desktop — movie trailers, music videos, YouTube. This idea of being able to watch video from somewhere else on a desktop has really gotten to be ingrained in the user community, so the idea of being able to surveil their own property has caught on.”

Customers seem less tolerant nowadays, thinks Bud Wulforst, president of A-1 Security, Las Vegas. “They seem to be price-driven to a degree, but it’s probably more the lack of loyalty,” he observes. “You had loyalty years ago, and the opportunity to address any mistake or error.

“Today, if you make a mistake, a lot of times your customer is gone before you even know it,” he asserts. “I think the customer in general is less tolerant of poor performance.”

Some security dealers and systems integrators say they are feeling a pinch from the Internet and from more educated buyers.

“The Internet is actually starting to affect margins, more so when you’re into the smaller systems — the 32 cameras — because people just go on the Internet and look at it,” points out McMillan. “If you can buy that unit for $3,000, why are you selling it for $6,000? I haven’t felt it too much; I’ve had some clients hit you on that. It’s definitely another factor that’s a problem.”

How does he handle it? “A lot of tapdancing,” he laughs, adding that he explains the value and reliability of the systems and service that is included in that price. That works with his bigger and referred clients, but not always with everyone.

“A lot of times, you have to come down on your margins on it, and it hurts, because long-term [if] you keep doing that, you don’t have the things you need to stay in business,” McMillan concedes. “That’s why I try not to get myself into that position.”

An example of competition from the Internet is provided by James Baker, president of Ultraguard Protective Systems Inc., Woburn, Mass. “We went in and proposed a $3,800 camera system,” Baker relates. But the client went online. “He bought a complete system compatible to what we were going to install with the labor for about $900 from a large wholesale club.

“You can go online yourself — you’d be shocked,” he exclaims. “I looked at the installation the customer provided for himself. It was good quality cameras, pictures, digital recording with adequate storage amounts and viewing remotely. That’s a big challenge for the alarm industry right now, especially with the smaller systems.”

Will Electronics is being hurt by distributors that market directly to end users, according to Kurt Will, vice president. “That had an impact on our business at the lower end,” Will reports. “You walk into a customer’s office and he’s got a security camera catalog laying on his desk. I don’t think that’s such a good thing.”

Will overcomes this with, “Service, service, service,” he chants. “We try to make sure we are concentrating on the right kind of customer that understands the value of that service.”

MARGINS GETTING SQUEEZED

Franklin agrees that margins are coming down for his company. “Equipment coming out now is a lot less expensive than it was, so that’s having an effect on our margins for video surveillance,” he admits. “I think we get more diversified clients in video surveillance, and again that ties in with the equipment becoming less expensive.“Now you’re getting a clothing factory that will have CCTV simply because it’s more affordable for them,” Franklin reports. “We’ve actually increased our client base, but our margins have dropped.”

McMillan is optimistic about margins. He expects margins to stay level in 2007, but the amount of profit to rise with the expected increase in his video surveillance business.

“Margins are still holding well,” he reports. “Our buying power has also helped, so we’ve got some better pricing for the most part. If I’m not the most expensive, something’s wrong.”

He points out the expenses of good labor, employee benefits, trucks and other signs of “when you have a real company.” Without these, companies do not stay in business, he maintains.

“Unfortunately, all these other guys don’t figure that out,” he says of low-bidding competitors. “All they do is muddy up the water for the longest time, and then somebody else is picking up the mess they created.”

Another problem McMillan sees with profit margins is the effect of large integrators bidding low on jobs to capture market share. “We all know no matter how well you buy, they’re not making anything,” he asserts. “How long is this going to last? How long before somebody else wakes up in that company and puts his foot down, and starts having them charge some realistic margins to make a profit?”

On a per-job basis, profit has probably gone down a little, says Walsh. He thinks the amount of training on- and off-site required for the new, more technologically complex systems is cutting into his profits.

“That drives costs upward,” he points out. “In the past, security alarm systems and camera systems were real basic, and not a lot of it was high-tech, so the average security installer didn’t have to understand anything about computer or IP addresses or networks. You also have to pay your employees higher wages, because the knowledge base of what they’re bringing to the job is higher than it used to be.”

Will also has experienced a decline in profits. “I think the IT distribution model that is working its way in our industry has been pretty hard on margins,” he declares. “We’re being a little more selective about the jobs we’re going after.”

Labor and equipment costs are cited by Wulforst. “We’re in a very tight job market, so labor tends to run pretty high,” Wulforst declares. “Equipment is such a big percentage of a lot of the bigger jobs. Equipment sometimes can exceed 60 to 70 percent of the job. Margins become really critical in that area, so the markup on equipment is difficult.”

Harbour’s profits are being affected by imports. “Knockoffs are killing us,” she decries. “It looks the same, but it’s half the cost, and right now that’s a serious competitive issue for us. We are constantly going in there and justifying our price and products.”

Franklin agrees that equipment costs are affecting revenues and profit for his company. “Revenues are down a little, and I think that’s because the price has fallen on the products,” he concedes. “Profit declined — less expensive equipment is the main factor. We’re working on more jobs now, and that’s more opportunity for a job to run over or go wrong. I think that’s where we’ve seen our decline.”

Franklin thinks some of the reasons for profit decline at his company were internal. “We’ve rearranged our project staff,” he announces. “That was the biggest problem. We were just hit with too many projects at once, and we were scrambling to adequately project manage them. But we’ve identified that now, and hopefully we will be getting into more profit in 2007.”

Gonzalez also is feeling the profit pinch in his retailing and hospitality niche. “We have made a decision to pursue more municipal, government and homeland security work, which has a different margin than our traditional commercial business,” he reveals.

For Baker, profits have declined in smaller applications and increased in mid to large applications because greater expertise is needed. “You can get a lot more money when you start integrating with other security technologies installed at a facility,” Baker points out.

Baker thinks IP cameras are close to widespread acceptance and expects them to help his company improve its profits. “I think we will see the acceptability of IP cameras on a wide rather than select basis, and I think we’ll be able to get a lot more money, because we can do a lot more with IP cameras.”

ADVERTISING AND PROMOTION

The experiences with marketing and promotions among security dealers and systems integrators have varied. SDA Security has had success with “CCTV days,” at which a demonstration room is set up on-site and customers are invited to roundtable discussions and individual consulting with manufacturers’ representatives at lunchtime.Initial Electronics has used lunchtime for customer learning as well. “We did some lunch-and-learns, where the customer is brought in and can learn more about various products we have available for video,” relates Heather Czyzewicz, Initial’s business development manager. “We also had an appreciation lunch with a van there with CCTV equipment, so the customer was invited and also could preview different equipment and see the different products available. We’ll do more in 2007.”

SOMETHING EXTRA

BCI has created a virtual preventative maintenance program offering for its customers, which generates reports on the operation of the customers’ video surveillance systems.“We’re not physically on-site, but we dial in so customers know their systems are working, and they do not have to worry about their remote sites,” Walsh explains. “This is a proactive way to verify the systems are running properly and cut off any problems you may have before they happen. You’ll see a trend toward more of those types of services.”

Franklin is optimistic about 2007 because of the network-class systems being installed. “Video analytics are being talked about and will be the saving grace for the quality integrator, simply because the average trunk-slammer is not going to want to pick up that work,” he thinks. “But a good quality integrator will delve into the realms of analytics.

“That will be a big market for us going into 2007, especially with the quality clients,” he maintains. “It’s going to save them so much money on guard services.

“I think the potential for growth is phenomenal,” Franklin says of the security industry. “I think it will become more digital, which is going to be great for the industry, but we’re going to have to stay ahead of the curve, because we’re going to have a lot of these computer people coming into our industry. It is going to get more competitive, but we just have to stay one step ahead.”

Sidebar: Which Vertical Markets Will be Fruitful for Dealer/Integrators in 2007?

“We see the multi-location retailers as a target. It’s the smaller retailers that are not buying [video surveillance systems] for shoplifting only — they’re buying it for business management reasons. I think that market looks bright for the future.”—Bud Wulforst, president of A-1 Security, Las Vegas

“For me, it’s heath care, education and government.”

—Marty McMillan, president of Intelli-Tec Security Services LLC, Westbury, N.Y.

“Health care, financial, transportation — those are some of the key ones we’re focusing on right now.”

—Kurt Will, vice president of Will Electronics Inc., St. Louis

“I’d have to say retail — it’s one thing we Americans are good about is having a lot of places to sell a lot of things, which gives us a very big market to work with. That’s not to say we won’t work in school markets and government, but they are a little harder to work in.”

—Tim Walsh, vice president of BCI Technologies, Grand Prairie, Texas

“Car dealerships, banks, credit unions, large-yard retailers, and we’ve got a big component of biomedical out here in San Diego. Laboratories, biomedical, anything that is politically charged, when they’re testing and doing all these different things in the medical field, that puts them on the security radar, and that’s when they call us.”

—Shandon Harbour, general manager, SDA Security, San Diego

“Government — there’s still a lot of Homeland Security money out there. A lot of these Fortune 500 companies have money to spend, and they don’t mind buying quality.

I see growth this year with banks and brokerage companies. These are people who spend money.”

—Clifford Franklin, president of Sabre Integrated Security Systems, New York

“We do a lot of government work, some residential and surveillance work for large hospitals in the Boston area.”

—James Baker, president of Ultraguard Protective Systems Inc., Woburn, Mass.

“Hospitality and quick-service restaurants is where we focus most of our business. We are experiencing the most growth from public education and small municipal applications, like mobile video police cars.”

—Jason Gonzalez, CEO of Visual Management Holding System (VMS) Inc., Toms River, N.J.

“Universities are definitely one — they’re constantly looking to provide extra eyes on campuses. Municipalities are definitely going to be growing.”

—Heather Czyzewicz, business development manager, Initial Electronics, Chicago

Sidebar: Which Vertical Markets Will be Fruitful for Manufacturers and Distributors in 2007?

“Definitely the gaming business, which for Honeywell has been tremendous and continues to be very strong, fueled by the DVR side and the conversion from analog to digital. The airport space and the education market and retail continue to be strong. Those are the most active.”—Michael Scirica, director of global marketing for Honeywell Video Systems, Louisville, Ky.

“Large convenience store chains as well as gaming.”

—Mike Kim, technical sales manager for the Western region for Nuvico Inc., Englewood, N.J.

“If I had to choose my three: gaming, government and transportation, such as ports and airports.”

—Irene Lam, director of product management for American Dynamics Video Systems, a brand of Tyco Fire & Security, San Diego

“Government, retail, industrial, Homeland Security, all that kind of business is still just on the edge. A lot of business is going to go on the border patrol. We still see a nice growth in government. Retail people are consolidating their business. We’re seeing a lot of retail and a lot of contracts with major companies on the industrial side, the petroleum side.”

— Joe Olmstead Jr. , director of marketing communications for Pelco, Clovis, Calif.

“Casinos, municipalities are very big right now, as are convenience stores.”

—Gary Perlin, vice president of video products for Speco Technologies, Amityville, N.Y.

“Anyone in the retail sector and the hospitality sector would be the greatest growth potential for us.”

—Steven Weagle, general manager for Pacesetter Technologies Inc., Dartmouth, Nova Scotia

“Healthcare, education, transportation and retail — education is where we’re seeing an unbelievable amount of activity.”

—Rob Siegel, general manager video and software solutions for GE Security, Bradenton, Fla.

“Small business is going to continue to grow at a rapid rate — small offices that didn’t adopt the technology before, because of cost coming down and ease of use. Also schools and local government are big factors.”

—James Rothstein, senior vice president of marketing for Tri-Ed, Woodbury, N.Y.

“Government organizations, large infrastructure owners, railways, interstates, ports, energy plants.”

—David Humphrey, managing director of Virage Security and Surveillance, San Francisco

“Education, public sector (state and local), and retail. We see retail as a huge vertical market. Most vertical markets should experience a growth in video. We’re seeing video going into places like legal offices and real estate offices. Anywhere the public goes, we’re seeing an increase in having video surveillance.”

—John Gaillard, president of ScanSource Security Distribution, Greenville, S.C.

Sidebar: The Sophisticated End User

Noticing the IT education of many end users is Irene Lam, director of product management for American Dynamics Video Systems, a brand of Tyco Fire & Security, San Diego.“Now we’re seeing end users that are not just physical security directors, they are directors of corporate security with an IT degree,” she notes. “They have certification, and they work for the IT department. So the things that they demand of our products are not the same as they were before.

“The things you have to worry about now are bandwidth utilization and how it goes on your network,” she notes. “We are seeing much more sophisticated end users.”

This is somewhat true for end users trying to understand sophisticated video analytic systems, thinks David Humphrey, managing director of Virage Security and Surveillance, San Francisco.

“Although it’s better than it ever was, it still needs improving,” Humphrey reports about end user sophistication. “It’s our job to educate about what can be done and what cannot be done. To a certain extent, the technology is sometimes off-putting to people.

“The security industry has been [accustomed] to very simplistic technology, going back to the security guard. Now you’re talking about IP cameras worldwide and strong analytic behaviors. It can be daunting to people,” Humphrey says.

Joe Olmstead Jr., director of marketing communications for Pelco, Clovis, Calif., finds end users more sophisticated than they were five years ago. “It used to be that folks would come out of the military and go into the security business, but now we find people are going into companies out of college and with technical degrees, especially in the IT area,” Olmstead marvels.

Mike Kim, technical sales manager for the Western region for Nuvico Inc., Englewood, N.J., has noticed something else about end users.

“The end users are getting their hands into the security equipment and bypassing the dealers,” he maintains. “It tells you the end users themselves are doing their own research. Now that’s not necessarily a good thing, but it seems that’s where the market is going now. Online purchasing is a big thing nowadays.

The mindset that pricing drives everything is wrong, insists Nick LaBella, director of product marketing for CCTV at ADI, Melville, N.Y.

“Internet distribution is only one example of a product source that adds little or no value to the dealer’s business,” LaBella believes. “Most of ADI’s dealers understand that price shouldn’t drive their decision process, and that the overall value they receive more than offsets any pricing issues.

The decline in margins has not escaped the notice of distributors. “We still believe the margin in the product is healthy — [though] it has obviously come down,” comments John Gaillard, president of ScanSource Security Distribution, Greenville, S.C. “Having a great deal of manufacturers has a lot to do with the price going down and becoming a commodity in some, but not all, cases.

“Having too many manufacturers of video products confuses the marketplace, so end users have a hard time determining the proper solution,” Gaillard maintains. “Dealers have a hard time keeping up with who their competitors are.”

IP systems may help with margins, Gaillard thinks. “I do believe there has been margin pressure, more in the traditional camera world, but there are network services that the dealer can now sell to increase revenue potential,” he maintains. “Though there has been margin pressure, the support dealers provide should continue to bring them good margins. Now we should be seeing an increase in the amount of total solutions sold, versus just cameras," says Gaillard.

Some distributors see the pricing glass as half-full. “There’s an elasticity in the price of the cameras — as the price goes down, we sell more,” points out James Rothstein, senior vice president of marketing for Tri-Ed, Woodbury, N.Y.

Sidebar: IP Growth Is Expected to be Steady, but Incremental

Joe Olmstead Jr., director of marketing communications for Pelco, Clovis, Calif., expects his company’s new IP offerings this year to build its IP business. “We expect a good increase in our business to come from the IP product offerings, but that’s not to say we expect our analog business to go away,” he cautions. “I think that’s a misnomer.“A lot of people think IP will totally replace analog, and it may [far] down the road, but there are too many people who are dependent on analog products for one reason or another,” Olmstead thinks. “We expect to see incremental business growth from the IP offerings, not replacement business.”

He estimates the percentage of the company’s sales of video surveillance equipment that are IP-related to increase 5 percent this year to make up approximately 10 to 13 percent of the company’s products.

“Pure-play IP is not there yet,” maintains Irene Lam, director of product management for American Dynamics Video Systems, a brand of Tyco Fire & Security, San Diego. She thinks one reason might be hidden costs they do not consider.

“They don’t see network maintenance and network latency,” she points out. “If you truly want to always have a live view and when video is critical infrastructure, they run Ethernet-dedicated networks for video surveillance.”

Rob Siegel, general manager of video and software solutions for GE Security, Bradenton, Fla., sees a continued strong move to IP. “I don’t mean that to be trite, but we’re seeing it in particularly our larger customers and starting to see it come down to mid-range integrations,” he reports. “We expect 2007 to continue to see growth. The percentage is still in the 5 to 10 percent range, but it’s where a lot of the growth is coming.”

Imports

Among external factors influencing equipment sales are the ever-present imported security products, mentions Olmstead of Pelco. “There’s still a problem with products coming into the North American market that are much lower priced that will attract a certain portion of the market, but the quality and reliability of those products is often not very good,” he maintains. “Our business continues to grow very nicely, but would it grow even more if we didn’t have to fight that offshore product mix? I think it does impact us.”

*percentage of respondents to SDM’s 2007 Industry Forecast, conducted November 2006

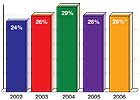

Sidebar: 9 in 10 Dealers Rate ‘State of the Video Market’ Good to Excellent

Dealers and integrators were asked: “Considering the economic health of your business, how would you define the state of the market and the potential for sales of video surveillance systems in 2007?”Nine out of every 10 security dealers rated the state of the video surveillance market and the potential for sales in 2007 ‘good,’ ‘very good’ or ‘excellent.’ Dealers rated video surveillance higher than access control and integrated systems, in terms of its market status.

*percentage of respondents to SDM’s 2007 Industry Forecast, conducted November

Sidebar: Remote Video Monitoring: Still a Niche Offering

Dealers and integrators were asked: “Does your company sell remote video monitoring services?”

percentage of respondents to SDM’s 2007 Industry Forecast, conducted November 2006

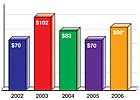

Sidebar: Remote Video Monitoring: Average Monthly Price

Dealers and integrators were asked: “What is the average monthly monitoring price you charge for remote video monitoring?”

*percentage of respondents to SDM’s 2007 Industry Forecast, conducted November 2006

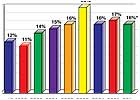

Sidebar: New Video a Significant Source of Installing Firms’ Revenue

Dealers’ and integrators’ percentage of total revenue from video surveillanceOf dealers’ total annual revenue, an average of 16 percent is derived from video surveillance projects and jobs, according to an SDM survey. The remainder comes from burglar and fire alarms, access control, and residential systems such as audio. How does this compare with your company’s percentage of revenue from video systems?