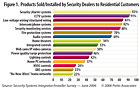

Products Sold/Installed by Security Dealers to Residential Customers

Source: Security Systems Integrator/Installer Survey — June 2006 © 2006 Parks Associates

Security system dealer/integrators are selling a lot more than alarm systems and monitoring services, and this part of their business is poised for growth.

Entertainment and control systems are becoming more capable, affordable and complicated, especially when consumers want to connect their various systems to each other and be able to control them centrally or from a remote location, whether that is out of the room or when they are away from home.

Introduce an entertainment PC and maybe an Internet-connected gaming device, and the combination of systems now becomes the interconnected offering that many consumers want, but few have the ability or time to set up. Many security system dealer/integrators can step in and capitalize on this emerging opportunity.

This is just one of the conclusions reached by Parks Associates, Dallas, which in partnership with SDM SmartHome has just completed the first of two surveys of the security systems and integration channel in the United States as part of its “Advancing Home Systems via Security Channel†multi-client study.

More than 400 dealers/integrators/installers participated in the research, which was conducted between May 31 and June 15, 2006. A total of 275 qualified dealers completed the entire survey. This article is a summary of some key findings.

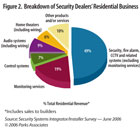

Figure 2. Breakdown of Security Dealers’ Residential Business

Source: Security Systems Integrator/Installer Survey — June 2006 © 2006 Parks Associates

PRODUCT CATEGORIES

Security system dealer/ integrators and installers are selling a wide array of low-voltage systems as illustrated in Figure 1. In addition to traditional security products such as alarm, CCTV, fire protection systems and associated monitoring services, many are offering audio systems, home theaters and a variety of control systems.The market for these non-security product categories is surging, as evidenced from Parks Associates’ primary research of consumers, residential home builders, and systems dealer/ integrators specializing in high-end entertainment and control systems. Security system dealer/integrators and installers are an important link in the chain from manufacturer to consumer.

The high end of the connected home market is the domain of custom electronics integrators and installers. They serve consumers willing to spend $15,000 to $20,000 for a multi-room audio system, $25,000 and up for a home theater and tie these systems plus lights and HVAC controls together for another $30,000.

These systems typically are installed in new homes costing $500,000 and more, which account for 1 percent to 3 percent of homes built annually and perhaps 1 percent of all homes occupied in the country.

Most custom integrators are not interested in the lower end, middle range or even simply upscale portions of the new-start or existing home markets. Tech support organizations, such as the various companies with “geek†in their names and the many other capable organizations, currently are focused on information technology products and not control systems, multi-room audio or typical home theaters.

Some security system installers are stepping into this gap and many others are considering such a move.

Figure 3. Dealers’ Influence on Brand Selection by Category

Source: Security Systems Integrator/Installer Survey — June 2006 © 2006 Parks Associates

CURRENT REVENUES AND PRODUCT MIX

On average, nearly 70 percent of the revenue for dealers selling into the residential market is from traditional security systems and monitoring services (see Figure 2).The remaining 30 percent represents the categories of systems that we believe can help dealers grow faster than if they remain in security alone.

Based on Parks Associates’ National Technology Scan (2005) conducted in the fourth quarter of 2005, 6 percent of the 109 million households in the United States are planning to purchase a home theater in 2006 and 5 percent are planning to purchase an audio system. Many of these systems will be sufficiently sophisticated to warrant professional installation and setup to take full advantage of their capabilities.

AN INFLUENTIAL CHANNEL

On top of this burgeoning opportunity for new categories of systems benefiting from installation lies the high influence security system dealer/integrators and installers exert on brands selected by their customers (see Figure 3).Not only are customers listening to dealers about which security system they should install, but they also follow their guidance about the brand of home theater, audio and control systems. This reality offers manufacturers and service providers a strong message -- build programs for your products and services that allow security dealers to offer them to their customers with confidence, support and margin.

THE BOTTOM LINE

Most security system dealer/integrators and installers are not currently offering non-traditional low-voltage products, specifically control, audio and home theater systems. When asked why not, the answers fell into three primary categories:- Our customers are not asking for them;

- We don’t have the expertise in-house to handle them; and

- We have all the work we need.

Finally, for those whose customers are not asking for these non- security systems, ask yourself: Isn’t it time you asked them?