Once only available to government clients, 3M is now bringing its security solutions to new sectors. With what the company described as a deep understanding of security threats that plague banks and financial institutions — identity fraud, data breaches, employee management and robberies — 3M’s proactive approach offers science-based solutions to help make banks and financial institutions safer and more secure, it said.

Authentication: Identity security starts with authentication. Banks and financial institutions are responsible for making sure their customers are who they say they are before gaining access to account information. This can be a difficult task, especially with the increased popularity of online and mobile banking.

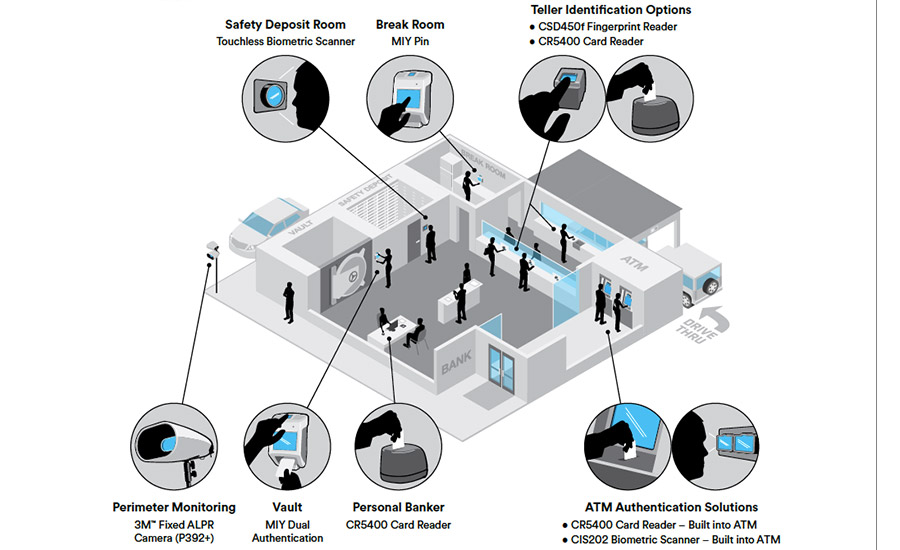

3M recently launched the CR5400 Double-Sided ID1 Reader, which checks IDs in double-time — reading the front and back simultaneously. This unique device does everything from age to document verification, including U.S. driver’s licenses to help ensure reliability while allowing bank tellers to provide better, more expedited customer service for everyday transactions. The CR5400 also can be utilized in the process of setting up new accounts or applying for loans to help safeguard against patrons opening accounts under false identities.

Access Control: The first bank in the United States was established in 1791; however, as the modern-day bank evolved, physical security changed to incorporate access control for numerous locations within the bank itself, namely keeping unwanted individuals from entering while granting access to individuals who are allowed in. Because of these complex security needs, banks and financial institutions cannot be subject to a one-size-fits-all solution; instead, multiple layers of security are needed.

3M MiY (“Make it Yours”) indoor/outdoor biometric access control products provide flexibility at the device and system levels, and allow for multi-layer authentication, as they contain a card reader, keypad and fingerprint scanner. This allows each reader to be customized per the location and security requirements of each bank location.

Employee Management: Tracking employee attendance, lunch breaks, accounting for accurate payroll, and background checks all can be tedious tasks, but 3M’s MiY access control product line can help remedy employee time management by tracking employee hours, whether by card, PIN or fingerprint, the company said, which also helps eliminate human error.

Businesses can support its human resources efforts with 3M LiveScan technology that gathers fingerprint and palm prints, resulting in a secure application that links to major background check databases managed by the state.

Perimeter Monitoring: While it is important to incorporate security measures into parking lot monitoring, it can be easily overlooked.

Automated license plate recognition (ALPR) offers a unique approach to parking lot security, allowing for continuous, reliable surveillance. 3M’s ALPR solution scans and records license plates with a level of accuracy and speed that exceeds the human eye’s capability, saving time and freeing security staff for other priority tasks, the company described.

ALPR cameras are constantly scanning license plates, and if the bank chooses to work with local law enforcement, this system can help the community by alerting linked agencies when the ALPR cameras detect vehicles on “hotlists,” such as lists of wanted felons or stolen vehicles. These devices also allow companies to make their own hotlists, such as former employees who are no longer permitted on the premises, to monitor and ensure perimeter safety.

“At 3M, we understand the importance and benefit for our clients in working with one vendor to help create an effective and streamlined security program,” said Amy McKeown, commercial security segment marketer at 3M. “Our product lineup simplifies security procedures and allows banks to customize and incorporate products as they see fit.”

Visit www.3M.com for more information.