State of the Market: Security & Monitoring 2017

The general outlook across the industry is highly optimistic as dealers and manufacturers ride the wave of integrated technologies and consumer interest to more and more growth.

Faraz Rehman, vice president of information services, Associated Security Corp., says 2016 was a “great year,” with increased integration both commercially and residentially. PHOTO BY DIGITAL CREATIONS FOR SDM

When asked (in 2016) about the current state of the burglar alarm market, 30 percent thought it was excellent; when asked to look ahead to 2017, an even greater number — 36 percent — said they anticipate an excellent market for sales.

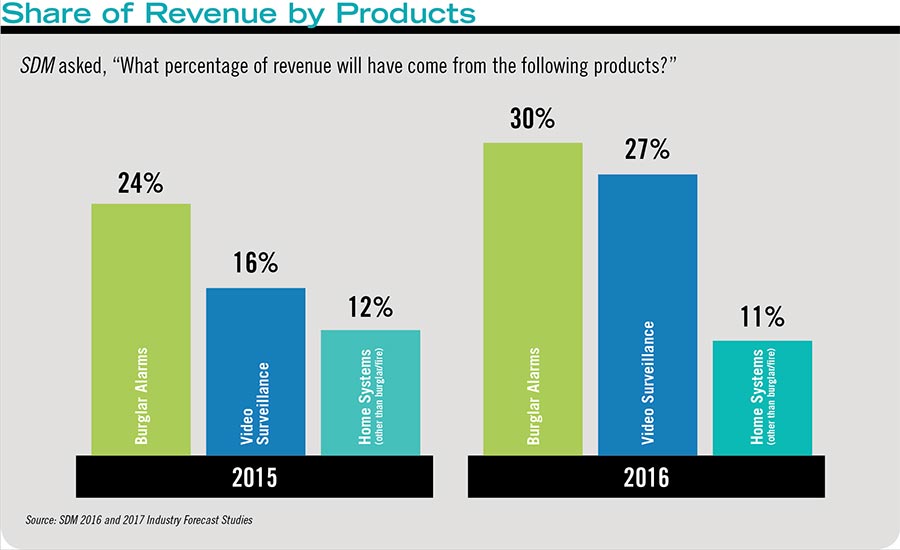

Respondents to SDM’s annual Industry Forecast Study were asked to state the percentage of their revenue by product category. In 2015 dealers and integrators indicated that 24 percent of total sales revenue would originate from burglar alarms, while in 2016 that number increased six percentage points.

The monitoring market is expected to remain strong, reflecting consistent percentages for the past few years.

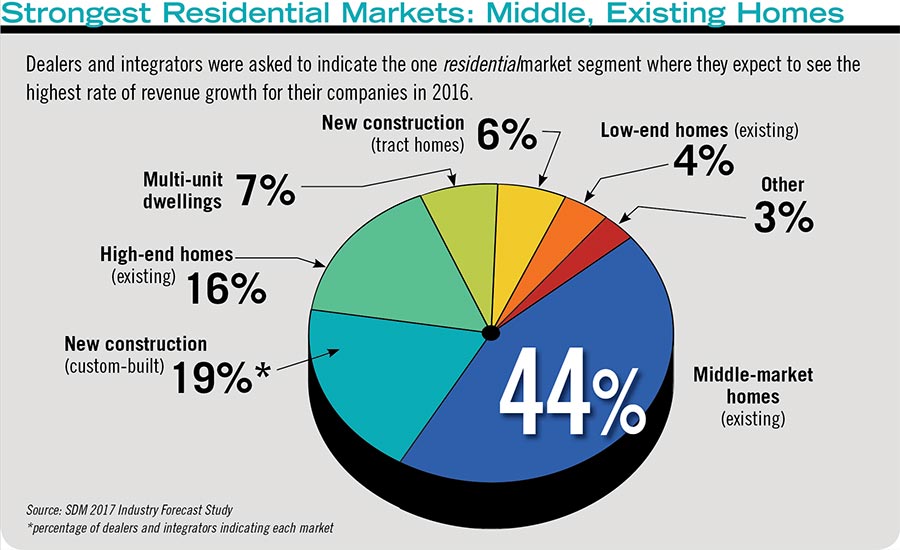

Existing middle-market homes are expected to be the fastest growing residential niche by quite a bit (rising six percentage points from last year).

Among companies that generate recurring monthly revenue, 83 percent noted an increase in their RMR in 2016 over 2015. Average 2016 RMR was 10 percent higher than average 2015 RMR reported in the SDM Industry Forecast Study.

ESA members report that their businesses on average spent approximately 19 percent more on products/solutions in 2016 versus 2015.

Satisfaction with professionally installed and monitored security systems remains high, providing some good news in a space increasingly crowded with DIY and other outside competition.

Dealers’ and integrators’ expected revenue change for 2016 is more positive than 2015, with 78 percent of respondents to SDM’s Industry Forecast Study saying their 2017 total annual revenue would increase this year.

When those who terminated service in the past year were asked the reason for terminating, 36 percent said they didn’t feel the service was worth what they were paying for it.

Here’s the good news: Not a single person interviewed for this article said business was flat or declined in 2016, or expected it to do so in 2017. In fact, many reported double-digit growth and a continued strong business outlook, both residentially and commercially.

Security dealer Wayne Boggs, president of Richmond Alarm Company, Midlothian, Va., described 2016 as “quite a bit better than 2015. I wouldn’t be surprised if it was in the range of 20 percent growth.”

Another metric that supports that 2016 was a very good year comes from the Electronic Security Association. “ESA members report that their businesses on average spent approximately 19 percent more on products/solutions in 2016 versus 2015,” says Angela White, ESA president and executive vice president of Central 1 Security Inc., Brookfield, Wis. “2016 was an incredible year. I’m not sure that I was prepared for how strong the year would be. The market is growing and there are tremendous opportunities to capitalize upon that at every turn.”

SDM’s own research, the 2017 Industry Forecast, conducted in November 2016, also reveals a positive metric in the intrusion (burglar) alarm category. By share of total revenue, burglar alarms comprised 30 percent, a 6 percentage point increase over the previous study. (See chart, this page.)

Some of the growth in 2016, particularly on the residential side, could be attributed to the 2G sunset, which had a December 31, 2016, official deadline (although many, if not most, towers are still running and dealers continued to finish up upgrades into the new year).

“The transition from old to new technology is contributing to growth. IP and cellular communication adoption continues to grow as dealers upgrade existing systems to replace telephone line communications,” says Paul Garms, director, regional marketing — intrusion, at Bosch Security Systems Inc., Fairport, N.Y.

For companies that specialize in the communication path side of the business, the general view is that new offerings, technology and partnerships will only continue the momentum.

“2016 was all around a better year for Telguard,” says Shawn Welsh, senior vice president of product line management and marketing, Telguard, Atlanta. “It would have been really disappointing had it not been a better year. But I expect 2017 to still be pretty good. The trends that drive our particular segment of the industry aren’t changing.”

These trends include evolving consumer needs, wants and desires, and the lightning-speed changes in consumer technologies that benefit those consumers both on their own and — more importantly for the security industry — as an adjunct to a security system.

“The consumer we are targeting today is not a person driving a ‘Model T’ anymore,” says Keith Jentoft, integration team, Videofied (a Honeywell Security and Fire company), Melville, N.Y. “They have changed even from three or four years ago. They want the smartphone to be their command center.

“Consumers are changing and the entry of these other ecosystems that are over and above security is opening up doors we never had access to before,” Jentoft says.

Boggs thinks the two greatest changes he has seen in recent years are the communication paths going from POTS to cellular (and eventually to Wi-Fi and Internet), and connected services via smartphone. “Ninety-five percent of the residential work we do today is cellular communications and remote services.”

Garms at Bosch says the use of cloud-based connectivity to systems is making it faster and easier to connect for remote programming and for end-user app connectivity. “This can eliminate the need to change customer router settings, firewall results or to use DNS for remote access. Dealers can now choose whether to connect direct to control panels or to use cloud-based connectivity, whichever method best meets the needs and requirements of each end customer.”

It is impossible to talk about residential security today without noting the impact that interactive services and increasingly full home automation are having on the industry as a whole.

In fact, a just released study from research firm Strategy Analytics, “Smart Home: Disrupting the Security Industry,” explains that the current residential security model in the U.S. is undergoing major change. According to the report, “the traditional, one-way security systems are giving way to innovative solutions that meld remote monitoring and control as well as automation capabilities with notifications of security breaches and events homeowners want to be alerted about. These innovations are creating new options for consumers and driving changes in the way monitoring services and first responders react to emergencies.”

Dave Mayne, vice president, Resolution Products Inc., Hudson, Wis., says, “We were up in our core business, which is really the security dealer business, over 25 percent. We had really pretty strong growth across all of our product families, which are almost exclusively intrusion-related. But interactive was about 10 percent heavier than the other segments.”

Another major trend this year was that both in the residential and commercial sectors, service and RMR-based solutions increased.

“The trend continues to be towards RMR-based solutions and less upfront revenue,” says current CSAA president Pam Petrow, president and CEO, Vector Security, Warrendale, Pa. (SDM’s 2015 Dealer of the Year). “Whether it is in residential installations or commercial projects, this bodes well for cloud-based solutions, which are gaining acceptance…. Overall, for Vector Security, 2016 was positive. Home automation and, commercially, video continued to fuel growth.”

Steve Schmit, engineering manager – alarm certificate services with UL’s Building and Life Safety Technologies division, Northbrook, Ill., also notes this trend. “We are seeing the industry approach the market with services. Technology is such that users can interact with the security system in ways that weren’t possible before, which opens up all kinds of opportunities. We see folks not only introducing new security type services such as video, but that same pipeline enables your security system to help out with things like personal emergency response and home automation sorts of things.”

This is exactly what led East Hartford, Conn.-based dealer Faraz Rehman, vice president of information services, Associated Security Corp. (featured on this month’s cover) to call 2016 a “great” year. “We brought in a lot of new technology with the recurring model. Monitoring is what keeps our industry going and with home automation being integrated with alarms we have more chances to profit from that and more services we can give out to our clients. More than ever we see alarm systems integrated with cameras in the home. All these services are coming together that we couldn’t do before. 2016 really pushed the envelope for integration, I believe.”

Rehman, like a growing number of his residential dealer peers, has started calling his business a “residential integrator” because of the growing complexity of Internet of Things (residentially often referred to as smart or connected home) that are increasingly included in a residential security system. “We are in the smart device technology now. Everything has to be app-operated. In that scene we do end up working with a higher tier of clients that look for that marriage between systems. They are looking for customization. They don’t want a gold, silver or bronze package. They want something different than the Jones across the street.”

“With change comes opportunity,” Schmit says. “As people look at the new stuff that is out there and figure out what it can and can’t do, the ability for the dealer to get into the homes has never been greater. As a homeowner or small business owner, you can’t turn on the computer or TV anymore without seeing promises of great things in the future.”

THE SECURITY MARKET TODAY & TOMORROW

Despite near unanimous agreement that 2016 was significantly up, at least one study in the residential security space shows it was actually a small increase and that the improvement really began in 2015, says Tricia Parks, founder and CEO, Parks Associates, Dallas. “2015 was a good year for the residential security industry; so was 2016. Exactly because 2015 was very good, growth in 2016 is a rational 4 percent to 5 percent for the industry itself in terms of volume, or 1 percent to 2 percent of growth for security adoption among all U.S. households, after attrition is incorporated.”

Parks pegs the revival of the economy, beginning in late 2014, as the turning point. “The economy revived for the upscale first — the classical target of professionally installed, professionally monitored security providers,” she says.

Up to 25% The presence of a working security system in U.S. broadband households. Source: Parks Associates

Rehman also noticed that trend. “There was an upswing in 2016 for the construction in new homes. More millennials are getting married and their concerns are the same as 40 years ago: to protect their family. We do see a very large growth potential we are doing well with.”

Both commercial and residential alarm systems have a lot of room for expansion when one considers the penetration rate. Parks Associates puts the presence of a working security system at 23 percent to 25 percent of U.S. broadband households and the presence of professionally monitored security at 21 percent to 22 percent currently.

While more anecdotal, Jack DeMao, CEO of Columbia, S.C.-based Electric Guard Dog (SDM’s 2016 Dealer of the Year) says in the commercial business “the whole industry has a lot of white space where security in general is underpenetrated. There is an increasing awareness both for commercial and residential of the risks and the need for them to do something about it.”

Surprisingly, he adds, property crime statistics can be particularly hard to quantify. The latest FBI data, released in September 2016, actually showed a 2.6 decrease in the estimated number of property crimes in 2015. However, DeMao says this is due to a combination of under-reporting and confusion in defining “cargo theft,” which may categorize a truckload of goods as a stolen vehicle. DeMao cites crime as one reason sales of EGD’s electric fence, which is designed to deter more than report theft, are up.

Another solution that helps with reporting and police response also got a lot of attention this year: video. Video surveillance topped the list of technology segments reported as strongest by the SDM Industry Forecast, with a whopping 97 percent of respondents reporting the state of the video surveillance market as good to excellent. The top two categories for expected increase in spending were IP-network-based video cameras and video storage, followed by integrated systems, monitoring and intrusion alarm systems.

“This is a trend I see moving out from commercial to residential,” Jentoft says. “Outdoor protection is becoming less expensive and more in demand. Outdoor security [cameras] are less expensive because of cool analytics to make them work and we are seeing it being pushed on the residential side.” But the sweet spot is still commercial, and Jentoft adds, as prices have fallen, smaller commercial has become a big consumer of verified video response.

Many report that commercial business is rising in general and may, for some dealers, even eclipse residential.

“In coming years, the commercial base will exceed our residential base,” says Kevin McCarthy, national sales manager, EMERgency24, Des Plaines, Ill.

“If you have a dealer that is both residential and commercial, we are seeing a lot of vibrancy there,” adds Jorge Hevia, senior vice president of marketing and sales, NAPCO Security Technologies, Amityville, N.Y. “We see a lot of commercial activity out there…. Everybody wants to put in intrusion, fire, or access control.”

Garms says Bosch Security excels at offering systems that integrate security technologies together, an important factor for the growth of security integrators. “Systems that integrate intrusion, fire, access control, video, and communications technology can provide significant value and convenience. The system can automatically disarm when an access door is opened, or lock the doors when the system is armed. If a fire alarm occurs, the doors can be unlocked to allow quick first responder access and an automated announcement can be triggered with instructions for building occupants. Video snapshots of these events can also be sent to facility or security managers. As integrators become more aware of the capabilities of integrated systems, we see this as a significant growth opportunity,” Garms says.

The Sonitrol network of dealers, who primarily play in the commercial space, has seen significant growth in recent years, says Julie Beach, vice president of sales and marketing for the dealer channel at Stanley Security, Indianapolis.

“The ones we are seeing the most growth out of are the ones that are really focusing on keeping current with technology, not just doing the same things they have always been doing, but getting all their upgrades and communication paths.” Reflecting others’ assessments of the growing service aspect of the industry, Beach adds that the companies with not only the most growth but the least attrition were the ones that invested in customer care or customer service departments such as maintenance monitoring and health checks.

Video dominates here as well, with remote video monitoring topping the reported monitoring services offered in the SDM Industry Forecast at 62 percent (versus 55 percent last year), and hosted video storage and SaaS-based video management also turning in healthy numbers.

Those doing the best residentially are the ones making the most hay out of the consumer interest in remote services and home automation technology.

“The alarm industry continued to evolve in a number of positive ways in 2016,” says James Rothstein, senior vice president global security marketing, Anixter, Glenview, Ill. “The increased adoption and integration of various home technologies as part of a ‘residential system’ continued to gain traction throughout the year. Partly driven by technology, the standards of Z-Wave and ZigBee allow for a more universal approach toward interoperability within residential systems,” he adds.

Garns of Bosch Security says, “Products that support wireless standards such as ZigBee and Z-Wave are also being offered by more manufacturers, spurring growth in wireless security systems as well as system connectivity to wireless devices that enable home or business automation.”

In fact, the Strategy Analytics report predicts that by 2020 there will be more households with interactive security than traditional security.

It has already gotten to the point, Rehman says, that customers are starting to change the way they think about their local security dealer. “Alarms aren’t just for life safety anymore and people aren’t looking for just security. A customer will ask, ‘do you do thermostats?’ because they want to control the thermostat with the alarm system. We are walking into a sale with a life leisure system where before we walked in just as the alarm guy. My title at the grocery store isn’t the ‘alarm guy’ anymore. It’s ‘that’s the guy who did my smart house.’”

But not all dealers are on board with this concept.

“My sense is most of the tier two dealers are at least using [interactive services] on a bigger percent of their business, but you still have 40 percent of systems connected over phone lines,” Mayne says.

McCarthy at EMERgency 24 knows of dealers who have been in the industry a long time that don’t want to move with the times. “Maybe they have built a nice business; it is providing a lifestyle and they continue to do what they have done for decades, or maybe they are fearful of it,” he ponders.

But more and more at least realize they need to start offering it, Hevia says. “Two years ago I would have said smaller dealers did not really get involved with interactive services. Now because of competition every one of our dealers is doing some level of connected home services, even if only arming and disarming panels remotely on an app. Everybody is getting into the act, and it is very competition driven.”

On the other side of the scale, the largest dealer network in the U.S., ADT, is leading the way. Jim Vogel, senior vice president of dealer operations based in Aurora, Colo., says more than two-thirds of sales last year had Pulse (ADT’s connected home offering) attached.

“[2016] was a great year. We really went into it with goals to grow, retain and automate and we hit it on all cylinders. We just completed our 10th consecutive quarter of year-over-year growth,” Vogel says.

Across the board, manufacturers, dealers and other industry players are optimistic for growth, not just in their individual businesses, but in the market overall.

69 % of security system professionals expect to complete at least one acquisition in the next year. Source: Capital One

“I am anticipating that 2017 will be another growth year,” Petrow says. “I believe the industry is becoming more nimble and that will be critical in the coming years.”

ESA’s White anticipates “explosive industry growth” in 2017. “Commercial clients understand that the solutions we provide are investments that mitigate their risks…. On the residential side of our business we see extremely strong growth as well. One reason is the 30- to 40-year-old generation wants and understands the immediate gratification information we deliver. The ability to access and manage information is an expectation that is affordable enough to satisfy a mass market.”

COMPETITION & THE CHANGING CONSUMER

For years the residential security industry has sat at a stable level of market penetration. As cable companies, MSOs, DIY companies and others encroached in recent years, the hope within the professional security space has been that all these efforts would lead to opportunity and an overall growing of the market, particularly with the advertising dollars that both the larger players and the popular consumer DIY players have been pouring into the market. For the first time this year, there are rumblings that maybe that is starting to be the case.

“This industry is seeing an incredible growth of competition from service providers and large security companies that are offering interactive security and home automation and driving consumer expectations,” says Greg Roberts, vice president of marketing, Icontrol Networks, Redwood City, Calif.

“We still see a genuine interest in consumers in professionally installed [and] monitored security solutions. Undoubtedly there is momentum in the DIY security space, but we honestly think it broadens the market more than representing a competitive threat,” Roberts says.

That isn’t to say dealers don’t view them as competition, however. For the second consecutive year SDM’s Industry Forecast Study cited DIY security providers as their greatest competition in the coming year, with 33 percent of respondents choosing DIY companies as their No. 1 competitive threat. National/global security companies followed, at 28 percent of respondents. However, wireless phone providers/broadband providers fell to 7 percent as a perceived threat, down from 11 percent last year. In all cases, it seems dealers and manufacturers alike view competition as untapped opportunity, a philosophy that also factors into the healthy optimism this year.

Respondents listing DIY providers as then greatest competition in 2017. Source: SDM 2017 Industry Forecast Study

MSOs operating in the security industry were estimated to have billed approximately $84 million in RMR in 2016, giving them a 5 percent share of industry market, says Michael Barnes, founding partner of Barnes Associates, St. Louis, Mo. Barnes presented these estimates at the 2017 Barnes Buchanan Conference, held in February, adding that this represents 21 percent year-over-year growth for the MSOs.

“The MSOs and internationals are creating compelling connected home offerings and gaining traction, but we haven’t seen the dealer market sag,” Mayne says. “We have seen expansion of consumer adoption and the demand for connected home technologies. My optimism is that Comcast and AT&T can enter and all these things can happen and the dealer segment does not cave. That is what is all so encouraging.

“I don’t have numbers but my observations are that the most visible non-security providers seem to be bringing more people in. They have pretty good traction. We are seeing more people in the organization, more advertising and reasonable numbers. That shows the value of the market as a whole. I don’t think the independent will be shut down by Comcast. But I do believe they can use what Comcast does to their advantage to gain customers.”

Welsh has similar observations: “We have 5,000 security dealers we work with and they had a great year. We are hearing that the DIY systems are addressing a different segment of the market. They are not necessarily cannibalizing the market. [DIY] is a legitimate segment that is growing but we haven’t seen it be a significant factor for the small and medium guys. Even with the cable and MSOs that have taken share, I think that perhaps it is more at the big guy level. ADT and Comcast are going back and forth [for customers] while the independent security dealers win business by being local and being a part of the community.”

That is exactly what Rehman is noticing in his business. “The big companies are growing the market, not taking share away. They are trying to penetrate a market that never really had an alarm system before. They are already in the house for telephone, Internet or cable and trying to throw a spin in there to bundle this home security in. I have noticed that those national companies can’t give that personal service and we have gotten clients whose first alarm system was with a cable company. They call us to have that personal service and those calls are increasing pretty heavily.”

Boggs hasn’t seen much competition or benefit from DIY and the outside players. But that doesn’t mean it isn’t affecting his business strategy. “We think there may be a place for us in that DIY market. I would hate to see as big a trend as that is going to be and ignore it. We are looking at options.” What he is more excited about is the growing market overall. “I think we are going to be able to compete. I don’t think they [the likes of Comcast] will be able to take over the market. I was concerned years ago when the $99 and free alarms started appearing, so we started to do more commercial work. It changed, but it didn’t kill it. We still do a lot of residential. It just improved the installed base. The beauty of this industry is that installed base of systems in homes and businesses that are there regardless of who is living or working there. People like us who have been here and toughed it out have the opportunity to pick up some of that orphaned installed base.”

White’s company has seen an uptick as a result of some DIY offerings, she says. “We receive inquiries from consumers on DIY solutions. Once we have the opportunity to speak with them, some are satisfied with a DIY solution while others opt for a professional solution. Regardless of the choice, the call came as a result of DIY curiosity.”

ADT views the outside competition as a rising tide theory. “I think it is raising the awareness of home automation and protection, so when folks see that offer from Comcast, they think to themselves, ‘Is Comcast really in this business?’ [ADT has] a 143-year-old brand awareness. That is a powerful synergy and what makes 2017 so exciting,” Vogel says.

Behind the sense of optimism is concrete action. The security industry overall this year saw a number of very high-profile mergers and acquisitions: ADT and P1 merged; Alarm.com acquired portions of Icontrol (the rest went to Comcast); Honeywell acquired RSI (Videofied) and Xtralis; and numbers of other mid-level acquisitions occurred on the dealer side. This level of activity has seemed to step up in recent years and some speculate one of the reasons behind this is not just competition within the industry, but also increased pressure from the outside.

“P1 has a maniacal focus on the customer experience. They also brought their technology into the fold and all the back office support,” Vogel says of the merger’s benefits.

“Honeywell made two big acquisitions last year,” Jentoft says. “What we brought to the table was an entirely new solution set with wireless cameras and the whole value proposition of verified police response. It made us mainstream overnight and was a whole paradigm shift…. I am super optimistic now that I am with Honeywell. It would have been a scarier market for me as president of Videofied without all the backend options because it is becoming a more complicated scenario with all the IoT and connections.”

In addition, RSI’s new DIY offering last year, Dragonfly, also came along with the acquisition. “The 20 percent penetration of all available homes for traditional alarms is still kind of the same,” Jentoft says. “Those 20 percent are not leaving in droves to go DIY. That said, the 80 percent beyond that are now accessible to us because they have smartphones and they are looking for cool things. This is our foray from the 20 percent foundation to new things. We are not going to be able to get those new things the old way.”

Inder Reddy, general manager, intrusion and residential solutions, Honeywell Security and Fire, Melville, N.Y., says all this industry inter-mingling is a direct result of industry players needing better skills, software or technologies. Size also matters. “There are some very large players coming in. When you are trying to win consumer mind space and compete with a Comcast or AT&T, scale helps. It helps on the technology front, on the skills and talent front. There is a lot of private equity participation in our industry right now.”

White doesn’t see that slowing down anytime soon. “2017 will be a year filled with continued consolidation. The influx of private equity funds into this hot space will fuel mergers and acquisitions. There is continued interest from Internet giants and other entrants into this space that will cause disruption to the traditional business models. However, there is enough consumer demand to support the traditional and new business models that play in our sector. I believe most dealers and integrators will grow in 2017, provided they embrace the available technologies.”

UL’s Schmit gives the security industry props for how it has handled the influx thus far: “There have been interesting pace setters with traditional IT getting into homes. The alarm industry is running to keep up with them and doing a fairly good job.”

MARKET CHALLENGES & OPPORTUNITIES

There is a lot to be happy about in both anecdotal evidence and research. The connected home (beyond just interactive security) is becoming a mainstream opportunity for residential security dealers, while larger competitors are doing much of the advertising and legwork to spread the word. Commercially, small and medium businesses that are the bread and butter of the dealer are interested in more security and having it all work together.

But all of this also presents some challenges to the dealers.

“Parks Associates believes that the security providers can exploit huge opportunity in their markets through AI and through the smart home,” Parks says. “[But] it takes changing mindsets among salespeople and sometimes among long-standing corporate leaders. Those are difficult changes.”

Corey Boggs says his company’s central station experience shows the challenges. “In our experience with 150 independent dealers that use our central station, the overwhelming majority are not moving forward with this technology…. [Some] traditional small alarm companies are just not interested. It is over their heads. They will become irrelevant. Their businesses will have little to no value by the time they get ready to retire. It is a pretty big mistake on their part.”

Wayne Boggs adds, “Our experience with our dealers is that probably within the next five years most of them will be out of business. They either have to adapt to the IoT and connected service that the consumer wants, or they will be irrelevant and their market will collapse.”

It’s “Jack be nimble, Jack be quick time” for dealers that aren’t already on board. “DIY and the connected home will dominate the race for the home,” says Morgan Hertel, vice president of technology and innovation for Rapid Response Monitoring, Syracuse, N.Y. “The biggest threat exists for those with their heads in the sand. DIY, MIY and the idea of doing things differently is a great wave to ride if you pay attention. If you miss the wave and ignore it you are going to get buried if home security is your primary focus.”

There is an upside, however, Boggs says. “We probably have more opportunity than we have ever had in the past. We have more challenges, too, but they are not negative challenges…. A company of our size is relatively flexible when changes occur in technology and the environment. Even though it is a pain in the neck it is exciting to see the kinds of technology we have now compared to 20 years ago.”

Petrow, too, points to a challenge in staying technologically competitive. “We have to be able to change and adapt at a rate that is unprecedented. This means being faster to market with new products and services.”

For some, it means taking a first step, as soon as possible. “First and foremost small dealers need to commit to offering interactive services as part of their portfolio,” Icontrol’s Roberts says. “They can’t leverage what is happening if they don’t offer it. There are numerous platforms [now] that enable them to do that in a very turnkey manner.”

Mayne suggests that for the smaller, independent dealer it doesn’t have to be all or nothing. “How do you leverage some of the new devices entering the IoT space and how do you use what Samsung and Apple and Google do as an advantage in sales efforts, as opposed to competition? Suppose you pick a technology that integrates with an Amazon Echo or Google Home or Nest. The local independent dealer that knows their community they can say, ‘I live here and I have this device that is compatible.’”

Mayne sees this time as a distinct tipping point. “The industry is filled with people who want to very quickly be second. They want to see someone else do it, and then come on board. We are at that point now where people are starting to move.”

But “wait and see” may not be the best tactic, Hevia says. “The approach that a Ring or SimpliSafe and a host of others have taken is they have found out what the salient needs are with respect to consumers on security ... and done a good job of making products appealing. I think the traditional security companies can take a page out of these direct-to-consumer companies and market the product based on what people are dying to do, which is protect homes and families and alleviate problems. Traditional security companies would be well served to follow suit in their marketing and ad campaigns.”

Rehman’s company started leveraging social media and other online tools in 2016, he says. They did this in coordination with the 2G sunset, he explains, making sure they asked customers for the updated email information as they upgraded the communications path, whether or not they were able to upsell them at that point. “The idea is if you don’t want it now, maybe you will next year. We planted the seeds for a few marketing schemes.”

Marketing has changed significantly in recent years, he says. “Before, we could send out mailers. Social media has been a major change. People get their news that way…. I do believe social media makes us an equal player. The cost is so low. It is as simple as creating a Facebook page.”

The key is to be responsive, ADT’s Vogel adds.

“The most effective ones are the ones that say, ‘Mr. Smith, I’m sorry you had a bad experience. Here is what we have done to correct the problem.’” That is a huge differentiator, particularly in local markets, he says.

One thing many in the industry do caution about, however, is not to let the medium swallow the message. “There are a lot of things the industry is starting to focus on as enhancement to the core offerings; but it is important not to get caught up in buzzwords or even the technology itself, but what it enables the customer to do,” says Greg Blackett, senior product manager, Tyco Security Products, Toronto, Canada. “It is still very early days. The end goal is to enhance the existing products and make them more intelligent and help the customer reduce false alarms and bring their total security experience to the next level.

“There are a lot of point products out there that may do something but they are not a real, true security product….. Cutting through the noise and the clutter is an important part of our role, as is making sure they are all working together. ”

Cutting through the noise and the clutter is an important part of our role, as is making sure they are all working together. Source: Greg Blackett, Tyco Security Products

This sentiment is echoed by UL’s Schmit. “In a broad, general sense the biggest opportunity for the security industry would be to make all these systems and services work a lot easier for the common user. I believe that is where they want to head and the technology is getting to the point where that is becoming increasingly positive…. When your competition is the cable or phone guy, subscribers are sensitive to somebody who can make this easy for them.”

White adds, “Security companies need to have their eyes wide open. You must get out of the old school mentality of sticking with a traditional alarm system. There is opportunity around every corner in our industry. Market penetration is still relatively low and there is so much business out there that if you have the right mentality and want to grow, you can.”

Both commercially and residentially, the opportunity is exciting and real, says Samir Jain, general manager, enterprise solutions, Honeywell Security and Fire. “Convergence with connected building and IoT and how the industry is growing up and who is on board and who is not — there are a lot of tools that go into that and that is where I see a lot of excitement from our dealers.”

Reddy adds, “Residentially, while security may still be central, the real excitement is about driving the user experience where their interaction with the system is fun. I wouldn’t even call it security anymore. It is just your home system. Dealers who can get their customers to see that will succeed. And it is not going to be that hard because the consumer is already there.”

As for what is to come in 2017, White sums up what most in the industry seem to be thinking: “I am even more optimistic about this year! We just need to buckle up and hang on tight.”

Lessons From the 2G Sunset

Like Paul Revere, security manufacturers have been shouting the message for years: “The sunset is coming!” Did dealers and customers get the message on time? Did the predicted advantage of dealers having to go back to customers leading to upselling of more connected systems materialize?

The official sunset of 2G was December 31, 2016. That doesn’t mean all towers turned off on January 1, but they are being slowly phased out and most dealers attempted to convert as many as possible before that date.

“Even though we have been preaching it out to dealers for more than a year that this was coming, we still saw a huge chunk that didn’t do anything or didn’t do it fast enough,” says Julie Beach of Stanley’s Sonitrol division. “Now the towers are starting to go offline.”

However, she reports, those that did do the upgrades did get more business out of it. “They did a good job of going back and signing them on new contracts and new solutions.”

Telguard’s Shawn Welsh says in general the larger dealers were more organized than the smaller ones. “The smaller guys need to sell and keep supporting customers, so swapping out a unit may not have been top of mind.”

Those on the manufacturing side also learned some lessons, including about how to avoid the pain points the next time around.

Telguard is focusing on implementing LTE technology on all new installations to essentially “jump two sunsets ahead,” Welsh says. The technology is in their new products so dealers that are putting in systems now will automatically benefit down the road, he explains.

Other manufacturers did what they could to make this transition less painful. Honeywell bundled some products to encourage upselling, says Inder Reddy. “Even though the sunset was a huge concern a lot of dealers actually took advantage to go back to customers and provide them with more services. We bundled a 4G radio with a home automation device and we got really good uptick from the dealers.”

NAPCO offered a buy-back program that essentially paid for the radio, making it a $0 cost to their dealers.

“With the 2G we were dealing with a universe of tens of thousands of radios already installed,” says NAPCO’s Jorge Hevia. “That is why we ran the free promotion. We were trying to get the investment for our dealers to switch over down to as little as possible so it would be less of a financial burden on them.”

It worked well, according to one of their dealers. “We were able to go to our customers and say, ‘We want you to change out your old 2G radios. However, due to this discount we can pass that on to you, literally giving the radio away for free,” says Faraz Rehman, Associated Security Corp. “I think the 2G sunset really provided the ability to sit down with the customers and talk about a lot of the options they can have. It was a plus for us.”

But Hevia notes that there were still a good portion of dealers who waited until the bitter end. “I think a lot of the dealers that went through this conversion will be a little more proactive next time,” he says. He also notes that even with the efforts on their part, there was no getting around the fact that it was a burden for dealers, who had enough on their plates just to get the upgrades done — never mind trying to upsell customers or go out and find new ones.

“2G was a pain in the neck,” says Corey Boggs of Richmond Alarm. “It didn’t help us in any way…. We would do it for free to keep from losing a customer, but we did still lose some. I don’t know that we upsold a ton of those customers.”

The good news is overall communications technology is stabilizing, giving providers a better roadmap for what is to come.

Reddy notes that even during this transition those who used a dual path with IP had an easier time of it. “You will always have the Internet so maybe now we can say goodbye to sunsets. You can always change the radio but having IP as a backup you are not rushed in a time window.”

I am hoping the sunset conditioned people to expect technology refreshes and to consider that when they are making purchasing decisions. — Shawn Welsh, Telguard

John Milliron, vice president of sales, North America, AES Corp., Peabody, Mass., says the FCC costs for radio operating licenses is making that technology another leading alternative to cellular, with its constant upgrades. “AES-IntelliNet operators are recognizing the advantages of private wireless radio networks for alarm communication with proven mesh technology.”

Whatever the lessons, hopefully there will be fewer surprise elements in the future, Welsh says. “I am hoping the sunset conditioned people to expect technology refreshes and to consider that when they are making purchasing decisions.”

The Future of Monitoring

In the monitoring business big shifts are slower to be seen, but they are definitely there. One ongoing trend is the swing toward using third-party monitoring providers rather than maintaining a smaller, local central monitoring station. More and more small and medium size providers are choosing to offload the monitoring portion to focus on other aspects of their business.

“What I am really seeing is a lot of consolidation in the central station side of things,” says Julie Beach of Stanley Security’s Sonitrol network. “In the past a lot of dealers had their own small central stations. We are seeing a lot of that consolidate into the wholesale model. Running a 24-hour business is a pain. And when you are doing it on a small scale it costs more…. These big consolidations are a great opportunity for the wholesale central stations while giving dealers more opportunity to focus on what they are good at.”

These are decisions that may be coming down the pike, says Wayne Boggs of Richmond Alarm. “It’s getting to be a challenge from that side. There is so much new technology, monitoring-on-demand, texting, having the customer have an app where they can cancel an alarm from their smartphone. Those will be challenges for us and will require us to carry a capital budget every year to stay competitive in the marketplace.

“There is a trend to go third-party. Hosted services is definitely a trend. I would not at all be surprised if the [monitoring] industry doesn’t look completely different 10 years from now,” Boggs describes.

But Inder Reddy, Honeywell Security and Fire, says there are actually two schools of thought on where monitoring may be headed. “Some customers have absolutely said ‘We want to leverage our expertise so we are going to get out of the monitoring business and focus on customer service.’ But as software becomes more and more the way to do things, you could make the case that SaaS types of services are much more scalable and you don’t need to be so large to have economies of scale. For the moment it seems that a lot of active central stations are looking to outsource to wholesale and reapply that cash to grow their RMR business.”

Faraz Rehman of Associated Security Corp., holds the latter opinion at this point. “I believe what has changed is there are more signals letting us better serve our customers. With alarms years ago, there was one zone. Now with new alarm systems we are getting much more detailed information, helping us to grow the value of the account.”

His company is preparing for changes coming as a direct result of the changing consumer and the home automation/DIY/MIY trends. “What is going to be coming is on-demand monitoring, especially with the millennials, who are more apt to be self-monitoring. With an app they will be able to click a monitoring option that they turn on and off.”

Rehman and others refer to this as “hybrid monitoring.” This is much more of a slow climb than a fast change, however, says Tricia Parks of Parks Associates.

“The price of professional monitoring is a classic inhibitor to its adoption. Innovations and trials to determine the effect of no contracts, ad hoc monitoring and individual device monitoring are occurring or anticipated. It is likely that ad hoc situation monitoring will appeal to a set of households. Time will tell. In the short term, one to three years, it is unlikely that these new business models will affect the overall industry. Long term, there may be significant impact.”

Morgan Hertel, Rapid Response Monitoring, sees these options becoming more common. “On-demand monitoring services where subscribers will be able to purchase monitoring on a per-day/per-week rate will increase in 2017 and some manufacturers will add this directly into their traditional product/service offerings.”

In the short term, one to three years, it is unlikely that these new business models will affect the overall industry. Long term, there may be significant impact. Source: Tricia Parks, Parks Associates

Dealers like Rehman are preparing now. “We are actually working on a model to figure out how to offer that with our billing system,” Rehman says. “We are trying to figure out if we can create a feature on our website so customers can turn it on and off.”

Pam Petrow, Vector Security, also senses change in the wind. “Consumers’ willingness to take on responsibility for some aspects of monitoring will continue to change the industry. Whether it is a DIY with 100 percent self-monitoring, or some subset of events the customer self-monitors, this will impact the next evolution of monitoring. In addition, the way the monitoring centers communicate with the consumer is evolving … to be more responsive to consumers, communicating with them via the venues they prefer — this relates to alarm response, service requests, billing payment options, and even sales.”

Technology Solutions Are in Place

Strategic alliances are becoming a familiar sight in the industry when it comes to popular home automation technologies that have potential benefits to security system users. This mirrors the trend on the commercial side of open systems and integration with one or more complementary technologies, such as alarms and video.

In fact, a greater percentage of respondents to SDM’s Industry Forecast Study indicated their spending on non-residential integrated systems would increase in the coming year, from 56 percent in 2015 to 63 percent in 2016.

“The IoT is a key driver in the business; we are using a new controller to provide predictive analytics and drive preventive, rather than emergency service,” Electric Guard Dog’s DeMao says.

“One trend I am noticing in my business is that while physical safety is still a priority, consumers and commercial end users gravitate to the lifestyle benefits and convenience enhancements that we provide,” ESA's Angela White adds. “They still want to buy that peace of mind, but that has taken on a new look. It comes in the form of being able to access and manage everything in the palm of their hand…. Full function remote access is the beginning of the conversation, not an accessory.”

In fact, residential “integrations” are what continue to set the professionally installed market apart, particularly from point solutions and DIY options.

In recent years, manufacturers have stepped up to the plate to make things more even for not only the large security companies but smaller independents as well.

Staying current is top of mind for most manufacturers, but with so much outside of the industry competition, it is even more critical for residential security manufacturers and their dealers. “That is what guides our product development going forward,” NAPCO's Jorge Hevia says. “We want to leverage those ecosystems that exist out there with the Internet and smartphones and everything that is already in place and still come out with products that keep our professional installers relevant. We have seen a lot in 2016 with DIY and other direct-to-consumer models. What we are going to concentrate on is enhancing professional security or connected home experience.”

We want to leverage those ecosystems that exist out there with the Internet and smartphones ... and still come out with products that keep our professional installers relevant. Source: SDM 2017 Industry Forecast Study

From voice to video, the “it” technology of the moment has a positive effect on dealers, says Greg Blackett, of Tyco Security Products. “A lot of these products drive interest in security. There is an opportunity there in the form of reaching a customer that hasn’t had security before by delivering new products. Maybe they will start with a point product but then possibly migrate to a more secure, professional solution. Those are the types of things that will help us….. As an industry we are doing good work making sure products can connect in a meaningful way.”

Dealers are noticing. “We have available to us a fully integrated home automation package that is easy and convenient for consumers,” says Pam Petrow of Vector Security. “This really is a competitive advantage against some of the players that have individual pieces that are not integrated or require multiple apps to run the automation. Commercially, the hardware offerings are better from a technology perspective and the pricing is at a point where wider adoption occurs.”

Corey Boggs of Richmond Alarm, agrees. “The connected home is here to stay. We now have the resources to meet where the customers are and what they want. We are better positioned today.”

Self-Install Security Systems Are a Market to Watch for Renters

Parks Associates research shows more than one-third of U.S. homeowners have a functioning security system, but only 14 percent of renters do. The behaviors of these consumers provide insight into the issues and challenges facing the residential security industry, and how those behaviors will impact smart home systems.

While security system ownership has been lacking among renters, many of the new security device players, including self-installable portable security systems, hope to crack the untapped rental market. Achieving this feat means offering lower cost security or peace of mind solutions. The rise in self-installed security solutions is aiding that effort.

While only a small percent of security systems are now self-installed, this is an area to carefully watch, especially as more full-featured self-installable systems enter the market. Installing dealers must closely monitor this trend and game play counter strategies as this trend continues.

Homeowners who acquired their security system as part of the purchase of a new or existing home. Source: Parks Associates

While homeowners are nearly 2.5 times more likely than renters to have a working security system, a significant portion (43 percent) of recent buyers acquired their systems as part of the purchase of a new or existing home. While interactive services have taken hold in the industry, radically improving customer satisfaction and retention, the addition of home control products including lighting and thermostats has also expanded the value of security solutions. Bundling smart energy, home security, and smart home services has made the security industry the leading channel for smart home services.

Despite the combined marketing efforts of huge brands entering the market, consumer awareness of smart home solutions remains low. In Q4 2015, only 15 percent of broadband households were familiar with smart home solutions or where to buy them. In Q2 2014, 10 percent of broadband households were familiar with smart home solutions. While a 50 percent increase in familiarity over 18 months is good, there is still a long way to go. Therefore, the security industry and its personalized sales approach will continue to lead the smart home market for the next several years.

However, it is also clear that some change is in the air. Purchase intenders of these same smart home devices report a significantly lower likelihood of purchasing desired devices as part of a security system acquisition. Most of these intenders are interested in purchasing the desired device as part of a smart home control system instead.

As consumers actually shop for their products, they may find it easier and less confusing to acquire these devices from a security system provider, with or without professional installation. On the other hand, increasing awareness may translate to higher consumer comfort with acquiring a smart home controller and then attaching desired devices. One catalyst for these sales could be the Amazon Echo, with its early success, broad visibility, and broad partnerships.

Potentially strengthening the Echo’s case is the fact that a sizeable group of security system owners appears neither satisfied nor dissatisfied with their current service provider. This group represents 34 percent of professional monitoring subscribers, creating a significant opportunity for smart home controllers and other hero products like the Echo. These customers represent a vulnerable group of users who could switch providers, try out a new ad-hoc monitoring service, or cancel altogether.

This is an area in which effective data analytics can provide a major benefit. If this group can be identified by common attributes, such as inconsistent usage of the monitoring service, then solutions or offers can be developed to pinpoint the needs of this group and potentially raise satisfaction levels.

Looking to move beyond the current 21 percent to 22 percent penetration among broadband households, professional monitoring providers may be hard-pressed to find a single silver bullet. Among consumers without a home security system or professional monitoring service subscription, no single feature had high levels of appeal. A service without a long-term contract was the most appealing to this group, with other features such as the ability to monitor a system using a smartphone or one that includes control of the thermostat scoring between 23 percent and 29 percent. Most alarming is that half of those without systems just aren’t interested — today or under any offered conditions.

This creates added importance to maintaining existing customers, and Parks Associates research shows these customers largely value price savings. When those who terminated service in the past year were asked the reason for terminating their service, 36 percent said they didn’t feel the service was worth what they were paying for it. This is why smart home kit vendors offering self-monitoring have the potential to grow more quickly by addressing the needs of non-traditional security customers. These customers are increasingly interested in home control and potentially security but not in professional monitoring fees. — Contributed by Tom Kerber, Director, IoT Strategy, Parks Associates

Finding the Right Technology Balance

An ongoing question for the security industry is how — and how much — of the new connected home products to offer or control, or just how open to be. Do you lock down home control products so only the dealer can sell to homeowners or allow the homeowner to purchase some things on their own? It comes down to how much control you want to allow the customer in choosing their own technology.

“We as an industry offer Z-Wave hubs that you can buy products for or you can buy them from the dealer and add them yourself,” says Shawn Welsh of Telguard. “The big issue is we don’t always let you by and large interact with the other consumer products you got for Christmas.”

Some manufacturers are starting to give the dealer that choice. “Our strategy is to allow anyone to interact with ours. We connect to systems that allow you to work with [Amazon’s] Alexa, for example,” Welsh says.

This type of option has been a benefit, says Corey Boggs of Richmond Alarm. “We need to take the responsibility of controlling that interaction in the beginning, bringing this to the customer. They may think they can go buy a Nest thermostat, but when we control that interaction we can still be part of the conversation. But I don’t want to roll a truck to your house because you want to buy a lamp module.”

Boggs says many customers actually want help install something like a lock or a thermostat, which they will do. But they try to sell as many of the items through their company, even if it doesn’t bring in a large profit, because then they are the one “integrating” it into the security system. “If the ability to enhance your system on your own keeps you paying me the $45 a month for that system, then I am all for it. The more you enhance it the more likely you are to use it.”

Check out more SDM State of the Market Reports

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!