PERS & Medical Monitoring: The Coming Convergence

Security dealers that sell PERS will want to keep close tabs on developments in medical monitoring in order to be better prepared for how the market may change as a result of increased convergence.

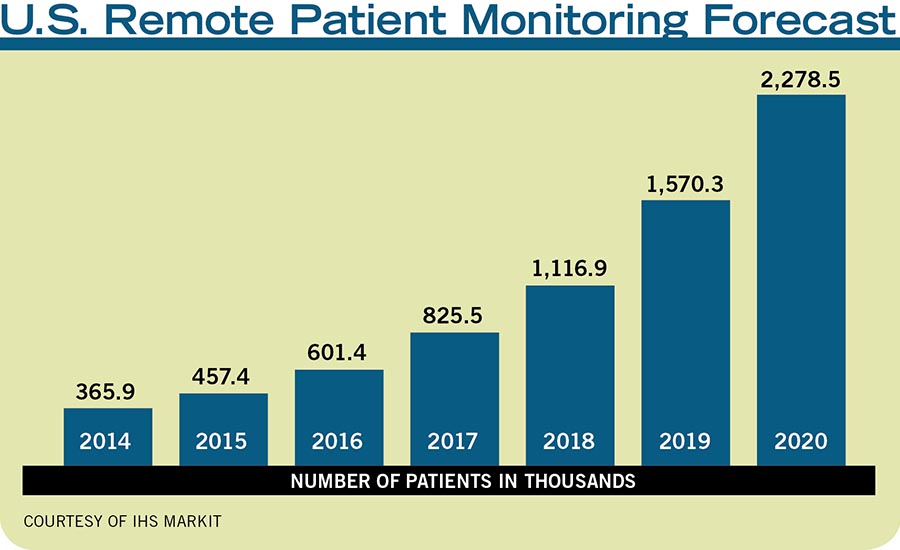

About 600,000 patients were monitored for medical conditions in the U.S. in 2016, generating revenues between $250 and $300 million. In addition, IHS Markit forecasts an average annual growth rate of 35 percent until at least 2020.

COURTESY OF IHS MARKIT

American Two-Way monitors a range of medical devices, including peak flow meters used for people with breathing disorders to measure lung capacity. PHOTO COURTESY OF AMERICAN TWO-WAY

PERS systems are backed up 24/7 by central station operators who can summon help. PHOTO COURTESY OF LOGICMARK

Medical monitoring systems use hubs at a patient’s home and the healthcare provider’s office, which are linked via the medical monitoring provider’s data center cloud. PHOTO COURTESY OF MEDM

Last year’s Catalyst conference gave attendees the opportunity to network with other PERS dealers. PHOTO COURTESY OF AFFILIATED MONITORING

Some experts say the convergence of personal emergency response systems (PERS) is coming — the only question is when. Another question, however, is what convergence will mean for companies that specialize in PERS.

London-based market research firm IHS Markit estimates that about 600,000 patients were monitored for medical conditions in the U.S. in 2016, generating revenues between $250 and $300 million. By many standards, that’s a relatively small market. But the market is expected to grow substantially moving forward.

San Diego-based Qualcomm Life is one of numerous companies that offers medical monitoring in the U.S. and elsewhere in the world. As Qualcomm Life President Rick Valencia explains, the company monitors key vital signs such as blood pressure, respiration rate and heart rate. The company focuses on providing connectivity from patients’ homes to a data center cloud that provides analytics and filtering before sending data to the healthcare provider. If, for example, a patient gets an unusually high blood pressure reading, an alert could immediately be sent to the patient’s healthcare provider.

As Valencia explains, Qualcomm sends “health information [and] contextual [information] to the caregiver in a clinically relevant way so that the caregiver can take action.”

Supporting the offering are what the medical monitoring industry calls “hubs” at both the patient and healthcare provider locations. At the patient’s home, a key function of the hub is to collect information from devices such as blood pressure cuffs, glucose meters, or scales that have built-in wireless connectivity. Today’s hubs can use a variety of communication methods to the cloud, including cable modems, DSL or cellular, but in the future Valencia expects the industry to move more toward cellular.

Qualcomm is paid on a per-customer, per-month basis for providing connectivity and cloud capabilities. Importantly, these fees are paid by the healthcare provider.

As Valencia explains, healthcare providers offer these services to certain customers with the goal of preventing problems before they become more severe and to minimize hospitalizations. Initiatives such as these are part of a broader trend in the healthcare industry away from being paid by insurance companies on a “fee for service” basis toward an “outcome-based” approach.

With an outcome-based approach, healthcare providers will be paid a certain amount of money on an annual basis for taking care of a group of patients, rather than being paid every time a service is provided. The goal is to incentivize healthcare providers to provide more predictive care and to avoid costly hospitalizations.

“Within five years, by my projection, we will see the majority of all payment for care being around outcomes,” Valencia comments.

Converged PERS & Medical Monitoring

The hub used at the customer premises can take a range of physical forms. Some are physical devices, while others are apps that run on tablets or smartphones. Another option is for an existing PERS device to also support medical monitoring.

Two companies that offer both PERS and medical monitoring are San Diego-based American Two-Way and Bala Cynwyd, Pa.-based Connect America. Both Connect America and American Two-Way have live operators to support their PERS offerings. In addition, both companies monitor key vital signs and operate clouds that apply analytics to that data and notify healthcare providers as specified by the healthcare provider.

American Two-Way also offers some services via clouds operated by companies with which it has partnered. Christopher Baskin, CEO of American Two-Way, prefers the term “telemedicine” or “telehealth” to describe the company’s offerings, which also include a service that monitors whether patients are taking their medicine and, if necessary, reminds them to do so via a call from an operator.

Connect America developed its own cloud platform and delivers its services via a PERS device that also connects wirelessly with medical devices in the home, explains Jim Reilly, vice president of telehealth for the company.

Expect more combination PERS and medical monitoring hubs moving forward, comments Michael Pliskin, CEO of Menlo Park, Calif.-based MedM America, a company that offers medical monitoring hubs and cloud services. Pliskin has seen interest from several PERS system providers in building medical monitoring capability into those devices.

According to Pliskin, one of the reasons medical monitoring hasn’t been widely adopted yet is that there has not been sufficient research to demonstrate the effectiveness of the technology in reducing healthcare costs. “The results are not impressive,” Pliskin observes.

Pliskin is not aware of any project that has more than 500 patients monitored. He adds that many offerings are voluntary on the patient’s part, with patients being able to stop at any time.

But despite Pliskin’s lukewarm comments, others see increased use of medical monitoring as inevitable. At least two market research firms forecast substantial growth for medical monitoring. Berg Insight expects the global medical monitoring market to grow at an average annual rate of 33.8 percent between 2016 and 2021. In the U.S. alone, IHS Markit forecasts an average annual growth rate of 35 percent until at least 2020.

Baskin believes medical monitoring will see a big jump in 2017 because federal and state programs such as Medicare will begin to reimburse it more broadly. Assuming the medical monitoring market grows as expected, it’s likely to have a substantial impact on the PERS industry. But exactly how the PERS market will be affected is a matter of debate.

The Impact of Convergence

In some ways, medical monitoring resembles the cloud services that security dealers already offer — including some dealers that also offer PERS. Dealers offer their customers the ability to remotely control their security systems using an app or Web browser by offering services delivered from data center clouds operated by equipment manufacturers and some third-party facilities.

There are some important differences between clouds supporting security systems and those supporting medical monitoring, however. First, the services that a medical monitoring cloud must deliver are considerably more complex than cloud-based security services. Richard Brooks, president of Connect America’s Health Care Division notes, for example, that the company customizes its offering for its healthcare clients, including interfacing with the client’s electronic medical records systems. That’s not the kind of work that operators of security clouds typically have experience with.

As Roeed Roashan, senior analyst for IHS Markit sees it, it’s likely to be easier for a medical monitoring company to move into PERS than for a PERS company to move into medical monitoring.

Another concern is that, while security systems and PERS systems are sold to end users, medical monitoring generally is sold to the healthcare provider. That’s an unfamiliar market to some security and PERS dealers, but as Valencia observes, any dealers wanting to get involved with medical monitoring “will have to decide they will step up to selling to healthcare providers and everything that comes with that.”

Medical Monitoring Standards

Two important standards in the medical monitoring market are HL7 and FHIR. Health Level 7 International (HL7) is an organization that has established standards for the transfer of clinical and administrative data between software applications used by various healthcare providers. The goal is to enable healthcare organizations to easily share clinical information. The same organization is also responsible for Fast Healthcare Interoperability Resources (FHIR), which define data resources and an application programming interface for exchanging electronic health records. The goal is to make it easier to provide healthcare information on a wide variety of devices and to enable the development of third-party medical applications that can be easily integrated into existing systems.

Direct to Consumer

There are some examples of medical monitoring being sold directly to the end user, however. Roashan points to the example of Forward, a San Francisco-based company that offers a service for $150 a month that includes medical monitoring, visits and emails to doctors and nurses at the company’s clinic, and some prescriptions. The company doesn’t take insurance and customers are still advised to get insurance to cover hospitalization and specialists.

Depending on how popular such offerings prove to be, there might be an opportunity for security or PERS dealers to offer a similar service or to resell that type of service from Forward or a similar provider.

Other opportunities may exist for companies that operate central stations, particularly those that already support PERS. Central stations have operators on staff to handle calls from PERS customers — and potentially there may be opportunities to leverage that capability to support medical monitoring. If a patient has a high blood pressure reading, for example, it would seem that it would be helpful for a live operator to alert the patient or one of the patient’s family members. The healthcare provider paying for the medical monitoring might not be willing to pay for that capability, but potentially the patient or patient’s family would be willing to pay for it.

It’s important to note though, that there are companies that operate call centers that specialize in supporting medical monitoring for healthcare provider clients. According to Anders Frick, senior analyst for Gothenburg, Sweden-based Berg Insight, many medical monitoring offerings give patients the ability to push a button to reach a call center. And the people staffing these call centers generally have certain medical certifications.

Any PERS central station wanting to act as a call center to support medical monitoring might need similar certifications and would need to be prepared to compete with the companies that already are in that business. Frick also notes that companies providing medical monitoring eventually may adopt automated voice response systems with deep learning capabilities, potentially enabling them to replace or at least minimize the need for live operators.

What’s on Tap for Catalyst ’17

As a central station with a strong focus on PERS, Affiliated Monitoring recognizes that marketing is critical to success with PERS. That recognition drove the company to organize the Catalyst Conference designed specifically to focus on marketing for PERS. Last year’s conference was a day-and-a-half event. This year’s event will be expanded and will be held May 15-17 in Miami. “People increasingly want to hone their skills in online marketing, pay-per-click, and marketing on social media platforms,” comments Daniel Oppenheim, vice president of Affiliated Monitoring. “They want to manage their cost-per-acquisition and they’re thinking about the different marketing channels that exist. There are a myriad of opportunities and people are always trying to get better.” The three-day event costs $395 and will include an in-depth conversation between Oppenheim and an as-yet-unnamed PERS industry veteran (at the time of writing) about how to succeed in the PERS industry, along with break-out sessions on legal and insurance issues as well as digital marketing. Oppenheim also will present information about the demographic changes driving PERS growth. “I take them through a lot of publicly available information and information we’ve accumulated over time,” Oppenheim observes. “It’s the most requested presentation of Catalyst afterwards.” Attendees also will have the opportunity to network with other companies pursuing PERS opportunities during organized activities including an opening reception, a golf outing, a Miami excursion, and a Miami dining experience.

Installation Opportunities?

Today the medical monitoring devices used in the patient’s home often are “plug and play,” meaning they don’t require professional installation. But if that were to change, perhaps there might be a role for security dealers to provide that installation. One of the latest PERS developments suggests that could happen.

Daniel Oppenheim, vice president of Union, N.J.-based Affiliated Monitoring has seen increased demand for monitoring what he calls “activities of daily life.” Typically installed in an older person’s home, this type of monitoring relies on motion detectors or other sensors installed throughout the home to confirm that the person is active. If activity is not detected for a certain period of time, the central station can reach out to the person or to a family member.

Potentially this capability could have applications in medical monitoring — and since professional installation may be required, there could be opportunities for traditional security and PERS dealers to handle those installations.

Oppenheim predicts another development in the PERS market that could benefit central stations with PERS and security expertise. “Video verification is coming to PERS,” he observes.

Video verification is already used in the security industry to help confirm whether an alarm signal generated by a security system was triggered by an actual intruder or, instead, is a false alarm. And although some people have had privacy concerns about using that capability to verify PERS alert signals, others see the potential benefits outweighing those concerns.

If video verification were determined to be appropriate for PERS, perhaps it also could play a role in supporting medical monitoring — and if so, that might present opportunities for security dealers to install the cameras and potentially to monitor the system and/or provide operator support.

Whatever happens with regard to the convergence of PERS and medical monitoring, a market for PERS-only systems is likely to remain. Even so, any dealers that sell PERS today will want to keep close tabs on developments in medical monitoring in order to be better prepared for how the market may change as a result of increased convergence and to be able to take advantage of any new opportunities that convergence may present.

MORE ONLINE

For more information about PERS and healthcare monitoring, visit SDM’s website where you’ll find the following articles.

“Affiliated Monitoring’s Catalyst Conference Talks High-Level Sales, Marketing in PERS Industry”

www.SDMmag.com/affiliated-monitoring-catalyst-conference-2016

“PERS Goes Mobile”

www.SDMmag.com/pers-goes-mobile

“How 4 Dealers Found Success in PERS”

www.SDMmag.com/4-dealers-pers-success

“PERS Continues to Expand with Greater Functionality”

www.SDMmag.com/pers-expands-greater-functionality

“Cellular Proving a Catalyst for Enhanced PERS Offerings”

www.SDMmag.com/cellular-catalyst-enhances-pers

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!