SDM EXCLUSIVE

State of the Market: Security & Monitoring 2019

Security dealers are increasingly taking advantage of the plethora of new technologies, business models and opportunities in the security alarm space, and seem to have found their footing in a rapidly changing landscape.

Craig Leyers from ADS in Nashville, TN calls 2018 “the best year we have had” and is similarly optimistic for 2019, both residentially and commercially.

Doomsday didn’t happen. For all the concern many security dealers have shown in recent years — particularly about the rapidly changing residential market — all indicators seem to finally point to what was always the hope in the midst of the fear: that all the new entrants, technologies and business models would start to grow the pie for all. Now dealers are finding their groove, changing their business models to compete or ramping up their commercial business to compensate.

Not only did the DIY doomsday not happen the way many feared, 2018 was actually quite a good year — great, for many — and a big part of that was the consumer awareness of the growing number of exciting security technologies out there, both residentially and commercially — the result of massive advertising campaigns by the DIY, MSOs and large national dealers.

“2018 was another year marked by substantial changes in technology, particularly with the deployment of more IT-based products and services,” says Pete Tallman, program manager alarm certificate service, building and life safety technologies, UL LLC, Northbrook, Ill. “End users’ appetites for new services have expanded opportunities for monitoring companies and dealers alike. Many traditionally minded companies have reexamined their business models and appear to have successfully adapted.”

Judith Jones-Shand, vice president of marketing, Napco Security Technologies Inc., Amityville, N.Y., agrees, adding, “There were many factors that contributed to the improvement, including continued strength of the economy and new construction in certain regions. Also, new technologies in and around the security industry, including cellular-centric ones, are evolved and being added at an increasingly fast pace. Lastly, there has never been more awareness generated about the importance of security in general.

The Cellular Connection

One of the greatest influences on the alarm market is one that dealers and manufacturers largely can’t control. As more households and businesses rely on cellular for their alarms, the inevitable sunset question arises every few years. January 2017 was the deadline for the most recent sunset but many dealers were still completing changeovers in 2018. There is no time to rest after this feat, however, as the next one (from 3G to 4G or LTE) is coming up, by all accounts as early as 2022.

“Today as an industry we are inexorably linked to one of the most dynamic technologies, the cellular space, as increasingly POTs are gone, and cellular communications need to keep pace with the huge carriers’ advances,” says Napco’s Judith Jones-Shand. This is a real change, and admittedly a challenge for both dealers and security manufactures; but it comes with newfound service and recurring revenue opportunities.”

The Monitoring Association’s Ivan Spector sees opportunity, but also risk, in the upcoming sunset. “We will see another cellular migration and this will likely yet again result in equipment being installed for minimal cost in order to preserve clients. This will present the opportunity to upsell those clients for new and enhanced smart services, but every time clients are asked to spend money it opens the opportunity to shop around for another provider.”

According to George Brody at Telguard, wireless technology, specifically due to landline cutting in both residential and commercial markets, is continuing to grow. “The number of American homes with only wireless telephones continues to grow, with more than half (54.9 percent) of homes being wireless-only during the first half of 2018, up 2.4 percentage points from the first half of 2017.” Commercial segments are also dropping landlines for cellular, he adds.

But with this comes the inevitable need for dealers to constantly upgrade their customers. While the industry is planning for the inevitable 3G sunset, new 5G is already creating a lot of buzz in the consumer world. Estimates are that 5G will be rolled out sometime between 2019 and 2021, which is exactly when dealers will be trying to go to clients to sell them on the 4G “upgrade.”

“We are already hearing all about 5G,” says Alula’s Brian McLaughlin. “The dealers, are going through the sunset of 3G and implementing 4G or LTE. Where does it end?”

Manufacturers are trying to make the next go-round less painful for dealers. Alula has gone to a sunset-resistant IP-first design with cell as the backup, McLaughlin says.

“We’re focused on enabling our dealers to not only maintain but provide value-added services,” says Resideo’s Alice DeBiasio. “When we launched Lyric in 2016 we designed our radios to be end-user replaceable. The focus is how do we minimize the impact of having to continuously roll trucks for every transition?”

Napco offered an upgrade promotion deal to its dealers last time and will continue that, Jones-Shand says. “The promotion helped us tremendously because we didn’t have to add those costs to the consumers,” says Napco dealer Jeff Raap, president, Fox Valley Security Systems, Elgin, Ill. He is more optimistic going forward. “Now that Napco is pulling out smart radios, people want that smart device to control their system. We are pushing that, doing upgrades and getting them off the old telephone lines and onto cellular networks.”

The key for dealers — many of whom did not have much success with upselling last go-round because they were so busy upgrading at the last minute — is to start thinking about the next sunset now, McLaughlin says. “For those that don’t embrace the sunset early it will be a costly fire drill. It is a truck roll, a new piece of hardware and not something I wish on our customers, but it is what it is. My fear is dealers will wait until the last minute and that creates chaos, confusion and cost.”

“There has never been a better time to be in security, given more varied technologies and involved companies, large and small. The industry is far more vibrant and relevant — 24/7 news cycles and social media continue underscoring the need, importance and value of securing one’s home, business and property. There have never been more exciting and potential technologies to apply in the field. … And there has never been as great a number of robust ecosystems that can surround and complement security systems and services for applications in the commercial, institutional and residential marketplaces,” Jone-Shand believes.

Mark Hillenburg, executive director of marketing, Digital Monitoring Products, Springfield, Mo., also reported a positive year. “2018 was a great year for us … much growth, added many new large key customers, and we had some really nice new products released that drove that.”

Peabody, Mass.-based AES Corporation is pleased with the U.S. alarm market. “AES performed well in 2018,” says Jim Burditt, vice president of sales. “The alarm market size continues to be on an upward trend for commercial, industrial and residential applications.”

Atlanta-based Telguard, a business unit of AMETEK Inc., also had a good 2018, according to company president George Brody. “2018 was a very good year for Telguard and overall the alarm industry performed well. Also, 2018 outperformed a good 2017.”

Several dealers interviewed for this story reported growth rates in the 20 percent range from 2017 to 2018. “For us at Bates our overall performance was our best year ever, both in the commercial and residential markets,” says Jeremy Bates, president of Bates Security/Sonitrol of Lexington, Lexington, Ky. (SDM’s 2018 Dealer of the Year, www.SDMmag.com/sdm-2018-dealer-of-the-year-bates-security).

“It was the best year we have had,” echoes Craig Leyers, senior vice president sales and marketing, ADS Security, Nashville (featured on this month’s cover). “My perception from talking to other similarly situated [companies] is it was a great year for our industry.”

ADS is 60/40 commercial to residential, Leyers explains. As a whole the company saw double digit growth on residential and even double again in commercial in 2018, he says.

These anecdotal responses are backed up by the research. “The alarm industry performed well in 2018 relative to 2017 across residential and SMB markets,” says Blake Kozak, principal analyst, smart home and security technology, IHS Markit, Englewood, Colo. “For residential in the U.S. the number of monitored accounts increased by about 7 percent, while for SMB the total number of accounts increased by 2 percent.”

SDM’s own research, the 2019 Industry Forecast Study, also saw positive results. More dealers and integrators —73 percent — expected a growth in revenue in 2018, when polled in September 2018, a 6 percent increase over the previous year. And 85 percent of respondents reported 2018 was a good to excellent year for intrusion alarms, up from 81 percent the previous year, while a whopping 96 percent expected 2019 to be at least as good if not better than 2018.

From a mergers and acquisitions (M&A) perspective the market also looked strong in 2018, although uneven, according to John Robuck, managing director, Capital One, Bethesda, Md. “Overall the alarm industry performed well in 2018 relative to 2017; however, the performance was not universal across the industry. Some sectors experienced substantial growth, resulting in an active M&A market, while other sectors had more modest growth given the increased competition and resulting pricing pressures.”

Robuck also attributes the growth to improved technology. “The growth sectors are benefitting from improved underlying hardware and software technology and the employment of business intelligence solutions … benefitting both residential and commercial dealers, while business intelligence solutions help to further strengthen the value proposition for the end customer and create new sales channels.”

The economy also played a factor in a better year. “Last year was a really good year for everyone in the building trades, which of course means alarm contractors,” says Kevin McCarthy, national sales manager, EMERgency 24, Des Plaines, Ill. “A lot of projects that were on hold got the green light,” he says.

“The economy has positioned consumers to have more money to spend and as security continues to integrate more naturally into their everyday lives, consumers see it as a necessity rather than a commodity,” says Christopher Denniston, director of marketing and contract development, Rapid Response Monitoring, Syracuse, N.Y. “Alarm platforms now have an even greater connectivity through smartphones. Customer engagement is significantly higher than in years past. It’s no longer about a keypad on a wall. Security doesn’t just turn on and off. Security is now a lifestyle. It’s on all of the time.”

No sector of the security industry has experienced more rapid change in recent years than residential security. From connected services to full smart home capabilities, rising competition from do-it-yourself (DIY), multiple system operators (MSOs) and the likes of Amazon and Google, residential dealers have found themselves in a bit of a head spin, and many were uncertain what the right answer was for their companies. Do they start offering professionally monitored DIY products? Double down on what they were already doing? Try to boost their commercial business, or get into that side?

Perhaps the biggest news in this year’s story is the traditional security dealer’s newfound confidence in which path to take. (See “Security Dealers are Meeting the Challenge Head On” on page 56.) Part of this is the realization that not only did DIY not take large shares of customers away, but the other new entrants aren’t doing that either.

“All indicators show the alarm industry is enjoying robust growth and interest in both products and services,” says Ivan Spector, president of The Monitoring Association, as well as Alarme Sentinelle, based in Montreal. “In many respects advertising has created awareness and has been driving client adoption of new technologies. Market penetration for years has hovered somewhere at around 22 percent to 25 percent on the residential side. With technology now providing us with the opportunity to install lifestyle enhancement systems, it would not be wrong to assume these rates will only rise in a relatively short period of time.”

John Loud, president, LOUD Security, Kennesaw, Ga., also sees the rapid rise in smart home technology playing a big role in growth for the whole industry, pointing to such items as video doorbells, wireless audio and smart garage doors. “The smart home of the future has finally arrived and it happened faster than almost anyone would have expected, which has allowed for new growth in a traditionally stagnant area,” he says, adding that the speed of change will only get faster. “I think our industry will change more in the next 24 months than we have changed in the entire previous decade or more. Companies that are able to keep pace, keep informed and work the changes into their business model will succeed. Companies that aren’t able to will likely see the next generation of consumers pass them by.”

While acknowledging the biggest threat to the industry likely comes from the large new players such as Google, Apple, Amazon and [the like], who come into the security industry in search of subscription-based business models, Jones-Shand sees the traditional dealer retaining their advantage. “They may know apps and network technology but they don’t necessarily know security applications, much less commercial codes or hardware — nor are they part of the local community like a traditional security company is, which can help serve to differentiate the small businesses that make up the majority of the traditional security dealers and alarm companies.”

What’s more, she and others add, these entrants, with their large advertising dollars, are really growing awareness and interest for all.

“As an industry we have seen new entrants, different business models, and DIY products flooding consumers,” says Alice DeBiasio, vice president, general manager, residential security business, Resideo, Melville, N.Y. “Out of the gate the security industry didn’t know how to respond to it and were perhaps a bit fearful. It’s certainly catching the eye of the consumer and what we as an industry need to do is think about how do we engage the consumer?”

Parks Associates estimates the number of broadband households with a security system increased by 630,000 households from 2017 to 2018 to reach 26.6 percent penetration. “Market dynamics within the residential security market are leading to changes in business models to better appeal to the approximately 70 percent of untapped households,” says Dina Abdelrazik, research analyst for the Addison, Texas-based research firm. “New business models include experiments with changes to professional monitoring subscription terms and innovative financing options. Furthermore, telcos and cablecos are securing their industry position. Offerings will increase at big box retail, through energy providers, and direct to consumers. With these strategies, leading residential security companies aim to increase their product and service mixes to retain existing customers and also appeal to a large, but untapped, market.”

Comcast’s Xfinity Home reflects that assessment. “It was a great year for us,” says Dennis Matthew, vice president and general manager of Comcast’s Xfinity Home, Philadelphia. “We are happy with the way the products continue to evolve as we lean into product innovation and integration across our platforms. About half of our customers are new to the category and trying home security for the first time. It’s great to see we are pulling folks into the category.”

Matthew sees more positive news ahead. “I am excited and optimistic about 2019. In our latest consumer research it is clear that people value peace of mind and the ability to get connected to your home. They want cameras, sensors and someone to come and install it. They want one app to manage it. … They are clearly articulating that this is the type of product and service they are looking for.”

Comcast is one of the MSOs and very large security dealers that are putting a lot of advertising dollars into the market, which is having a trickle-down effect.

“We had a good 2017, a much better 2018 and expect an even better 2019,” says Neil Appel, vice president of sales and marketing, B Safe Inc., Wilmington, Del. Organically the company grew 4.7 percent overall, which is above the industry average; with acquisitions, they grew almost 26 percent, he says.

“Residentially two things contributed to our growth,” he says. “First was the overwhelming availability of information and face time. People are more aware of security in their home and the apps, combined with other companies’ commercials make people aware. Second, people want to buy security today; we just have to convince them to go the traditional route versus MSO or DIY.”

All this advertising and interest has really become a rising tide, says Brian McLaughlin, CEO, Alula, St. Paul, Minn. “All the projections out there say that market adoption is going to double in the next five years. Visibility for security went from being a boutique thing and somewhat saturated to now you can’t watch TV or listen to the radio without hearing about security. ... A rising tide lifts all boats and while some professional dealers feared DIY would wipe them out, they are actually seeing the inverse of that and their interest in security increasing.”

A recent survey from Imperial Capital found that the number of U.S households with a security system — estimated at 32.7 million in 2018 — will swell to 41.2 million by 2020 and 63.1 million by 2024. (See chart on page 54.)

It is likely not all of that will be the professional market (there is no indication whether this incorporates DIY, self-monitored video and all other forms of residential security). But traditional dealers are increasingly optimistic that a large piece of the pie will remain in their column.

“We have no reason not to be bullish on what the future can hold for us,” Leyers says. “I have been here for 10 years and never forget how concerned we were about the MSOs or the telephone companies getting involved and how they would smash the local dealer. Instead we saw this awareness created. We have come to learn that SimpliSafe will run a commercial during the Super Bowl … I believe those types of campaigns cast a very wide net, and a subset of those customers will want that done by someone local and with experience. We are well-positioned to harvest that.”

It used to be that technologies and trends in the large commercial space eventually trickled down to the SMB space and eventually residential. Today’s society is consumer-first and as such the trends in evidence on the residential side are actually scaling up the chain.

“Certainly the commercial market is looking at these new technologies with a high degree of interest,” Spector says. “We see for the first time that the commercial market is following the residential market in features such as remote arming/disarming and observing what is transpiring at the workplace, addressing issues such as worker safety, employees working alone or in isolated areas and slip-and-falls.”

Is Video ‘Saving’ the Alarm Industry?

It is difficult to look at any aspect of the security industry without seeing the increasing reach and impact of video technology. Today’s video solutions go well beyond the old video surveillance systems. From DIY self-installed and self-monitored cameras to video verification, video is all over the alarm industry. In fact, some say video is the one factor having the greatest impact on the alarm industry.

“Video analytics and video cameras are helping to save the alarm industry,” believes Blake Kozak of IHS Markit. “In some cases video companies are even looking to partner with local law enforcement so that video feeds of an alarm can filter directly into a police car. Other trends of video verification are to reduce the time between receiving the video clip at an alarm company by delivering the alarm and clip in the same window message.”

Video-verified response is a growing trend in monitoring, Alula’s Brian McLaughlin says. “Some communities are mandating verification of a trigger, either by two-way voice or through a video. … We see that as a critical capability to really keep this industry relevant. Ninety-five percent of all alarm triggers are false. The whole network starts to break down if you are sending out that many false alarms. People lose faith, emergency response stops responding or taking it seriously. We see video verification and/or two-way voice as being critical enablers for the survival of the space we are in.”

Video dominated the landscape last year in both commercial and residential jobs, says EMERgency 24’s Kevin McCarthy. “Residential consumers are bombarded with offers for security systems that include video. They see the TV ads, news clips showing ‘bad guys’ caught in the act and shared social media content that repeatedly tells them they need video. Consumers are responding to that repeated message.”

B Safe’s Neil Appel saw this trend in his company, he says. “Regardless of budgets and size of the applications, everyone wants to know about cameras,” he says. Cameras go into 90 percent of our commercial quotes.”

Video monitoring as a service is another way video is expanding the alarm market, says Woodie Andrawos of National Monitoring Center. “We continue to see the rapid expansion of video monitoring as a service,” he says. “Our approach to addressing this monumental trend is making as much education as possible available to dealers. There are video solutions for all applications and verticals. Dealers who invest in researching the opportunities will be best positioned for continued growth.”

Interactive services for SMB in particular are gaining traction, Kozak agrees. “This means that the consumer can arm/disarm the security remotely, have access to cameras and in some cases thermostats and other devices. Between 2017 and 2022, the penetration of connected SMB monitoring will increase from 22 percent to 27 percent of all SMB accounts in the U.S. and the penetration of video will increase from 17 percent of connected SMB accounts in 2017 to 27 percent in 2022.”

There is the same level of expectation on the commercial side as there is on the residential side to be able to “interact” with security, says Tom Mechler, regional marketing manager, Bosch Security and Safety Systems, Fairport, N.Y. “Customers expect the ability to control their system and check system stats from anywhere and they expect that to be simple. This has been a staple of residential systems, but is now expected in commercial systems as well.”

Smartphones and smart devices have revolutionized residential and commercial security, Jones-Shand says. “It’s not just residential but commercial accounts, too, that are looking for remote connected business management services that security professionals can offer. This is especially true as brick-and-mortars face increasing competition and pressures. We, as an industry, are on the small screen to the tune of brand new relevance and RMR.”

This is good news for security dealers familiar with this world, but trying to escape — or at least hedge their bets in — the residential space. “Our company has not only had to move rapidly into the new residential model, but we’ve also made a concerted effort to shift our company into a stronger commercial position to hedge against the rapidly changing environment,” Loud says.

This is what they need to be doing, says Woodie Andrawos, president, National Monitoring Center, Lake Forest, Calif. “The biggest threat to business is inaction or not reinventing yourself in the face of a rapidly changing climate. Not adopting new recurring revenue opportunities and providing more value to the end user remains the greatest [danger] within the alarm industry.”

One of the other major trends is the increase in customer interest in the integration between intrusion, access control and video.

“More and more it is about the broader integrated systems combining access [and/or video] with intrusion,” Leyers says. “Our video sales were stratospheric, which has been great. We are finding ways we can start with a given client, maybe with video, and use that to grow our [intrusion] presence with that client; or start with intrusion and grow to video and access.”

Leyers also points to an excellent economy helping the commercial side of the business. “We are seeing lots of construction in markets we support in the Southeast. And I do think that consumers are looking at more integrated solutions … Consumers’ expectations for technology are changing. They expect to do more through their phone. Whether or not they learned that from home and want to apply it to the office, they really expect those types of broadly available and easy-to-access and -use solutions in the business as well.”

For Leyers’ company it goes beyond just the SMB space picking up on the residential trends, he says. “We have been watching this trend for some time where legacy solutions … are being replaced by interactive services … Where we saw it early was in light commercial. Now we are seeing it in the mid-sized commercial space. They have an expectation to interact with the smartphone to interact not only with security but also video and more than ever with access control.”

Craig Metzger, president, GMI Automation, Short Hills, N.J., points to commercial construction as the number one factor that led to sales growth and is optimistic for 2019, particularly in commercial fire, intrusion, access control and audio-visual (AV). He feels his company is ready for what comes next. “There is no question the industry is evolving. We feel that we have a clear vision of where the best opportunities are for GMI. We have the benefit of being nimble to adapt to the ever-changing market and stay wide-eyed open to the fact that things are changing and we need to move quickly and serve the best market that meets the client profile that is the best match for [our company].”

Integrated electronic security systems that can include a custom blend of measures such as intrusion detection, access control, video deployment for surveillance and investigation represent the biggest opportunities in the coming year, according to Tallman. “Systems that are tailored to the risk concerns of property owners and which are designed and installed to nationally recognized standards will offer … growth opportunities to dealers and monitoring stations. While it will demand enhanced training and skills of installers and service personnel, it will distinguish security services in the digital world.”

Leyers is very optimistic about business prospects in the commercial market going forward. “Commercially I can see us driving more into larger integrated solutions and continuing to double down on broader solution packages that combine access, video and intrusion,” he says. In fact, he believes security dealers are in a prime spot to move up in the commercial world, particularly as cloud and “as a service” offerings continue to take hold and some security integrators struggle to understand the RMR world. “It is harder for them to get that rolling,” he says. “One of the things I am excited about is we have that side figured out. … My hope is we can take those capabilities and grow into the larger integration side. It will pull more and more monitoring and intrusion services and all the other things that go along with it. Residentially we like to fish with nets, but commercially it is with harpoons.”

Residential and commercial security markets both have one thing in common: professional monitoring. Whether security dealers and integrators have their own central station or opt to use the monitoring services of a third-party central station, developments in monitoring are having an impact on the types of services they can offer to their clients, and the ways they can differentiate themselves from competitors.

There are several key trends happening, Spector says. “Monitoring is an area where the large, well-run and technology-capable third-party stations are able to offer a considerably lower cost on service. The value proposition to the client of their security alarm company continuing to operate on a 24-hour basis is diminishing. The central station software provider side has seen some interesting consolidation that will likely have an impact as clients will be enabled to cancel a dispatch via their smartphone. Eliminating the interaction is positive, as well as the reduction in cost. The adoption of AI will further lower costs, and many monitoring stations will adopt hybrid models and virtualize their hardware.”

Lowering costs is particularly important on the residential side, Parks Associates’ Abdelrazik says. “The security industry has performed well, increased its RMR to professionally monitored households and upped its value proposition. Now it must wrestle down another household segment, a segment that may be willing to pay something per month, but not more than $50.”

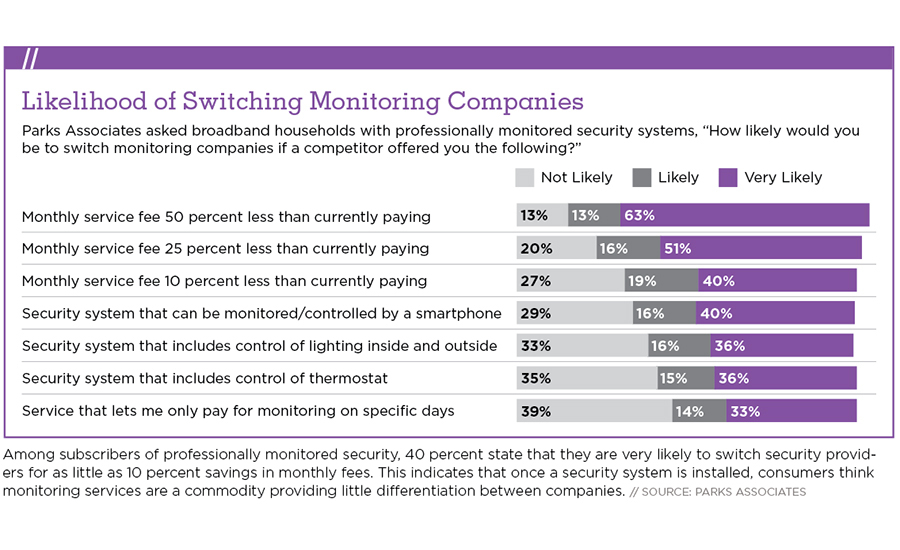

In fact, she says, among subscribers of professionally monitored security, 40 percent say they are very likely to switch providers for as little as 10 percent savings per month. “This indicates that once a security system is installed, monitoring services are a commodity service providing little differentiation between companies.”

That is something that dealers like Richmond Alarm Co., Richmond, Va., are setting out to change, says Brian Vanderheyden, CEO, Richmond Alarm. The security company has its own monitoring center and also monitors for 120 other dealers. “We are going to be making significant investments in 2019 in the customer experience of monitoring,” he says. “It will provide a better customer experience and allow us to respond to alarms quicker. These technology investments will enable faster response because we won’t have to focus our time on tracking someone four numbers down on a call list.”

Bates Security, which uses a third-party monitoring station, is also looking at what is out there for expanded features. “On the monitoring side we are interested in learning more about the use of text messaging and similar automation in interacting with our customers and handling alarms and dispatching,” Bates says.

Kozak says adding benefits beyond just security monitoring is crucial to increasing penetration, and one of these is video. “With advancements in video analytics and voice recognition, new possibilities are emerging to increase the efficiency of the remote monitoring process and alarm verification. By allowing computer processes to identify and verify the identity of the person who caused an alarm activation, central stations could save on costs related to staffing their centers 24/7.”

Video is everywhere today — from video doorbells to high-end professionally installed video monitoring systems. (See “Is Video ‘Saving’ the Alarm Industry?” on page 48.)

Security Dealers Are Meeting the Challenge Head on

Professional security dealers have faced their share of challenges lately in this fast-changing competitive and technological landscape. Yet, perhaps because the beam didn’t fall in the past few years as some feared, they are now seeing a clearer path forward. In many cases that signals a return to what they do best: security and service.

“Three years ago it was doomsday,” says Alice DeBiasio of Resideo. “It was pretty intense. Now many security dealers are saying, ‘I am different than these DIY products. I wasn’t sure of that a few years ago. But I enable comfort to a consumer. I am the person looking after that family.’ They have anchored down to focus on that aspect of their business. Others are exploring the DIY business model.”

Not only have competitors changed; the customers themselves are different. The more they are aware of the options, the more informed they have become. “Customers are often calling us knowing exactly what they want before they even pick up the phone, whereas in the past we had to be the trusted professional to guide each step,” says John Loud of LOUD Security.

“The industry has thrown a million changes our way, and next year we anticipate another million or two million more. But we have a great team and our industry is full of amazing individuals that truly care about what they do. Together, with the hard work that made us successful in the beginning, we will get through this and the opportunities to those who succeed will only continue to grow,” Loud says.

The trusted professional hasn’t gone away, however. While they might not need the hand-holding they once did, there is still an element of trust in what you know, says Napco Security Technology’s Judith Jones-Shand. “[Dealers] can position themselves in their community to be the local choice versus the global bureaucratic one. ‘Trust,’ the emotion security purchases are based upon, is often easier to achieve from a neighboring company instead of a multinational one … with a brand, but often not a face,” she describes.

Neil Appel of B Safe says his company has focused on revamping its marketing efforts to highlight this local angle. “We created a marketing department. We are very diligent with our social media posts, with charity events, alliances and doing everything we can to get people to know us. We are not going to compete with the TV ads, but we may sponsor a Ronald McDonald House event or have employees do things for MLK day.”

The local connection is the focus for ADS Security as well, says Craig Leyers. But they are also changing how they sell to consumers. “We really have changed our mindset on the residential side. We realized that our strength is our local connection to the customers we serve and the ability to offer security as a service … We have recently launched a new website. We are presenting customers with the ability to go in and design a system and see the pricing. All of that is very open and they can interact with professionals in our office, be guided through design and then get professional installation. We are not in DIY but we make sure we are supporting customers with pricing and empowering them to get access to information through our website.”

“I believe that verified video is going to be only a growing expectation within our market,” Leyers says. “We are positioned to not only confirm with a customer when their alarm is going off, but to be able to tell them and the authorities why the alarm is going off. … The expectation is to understand the scope of the alarm before they deploy resources. It is a great fit that is helping us drive both video and intrusion sales.”

Another growing trend Leyers points to is ASAP to PSAP. “Our ability to have and articulate the value of our monitoring service as being very advanced, supportive of new technology and ingrained and woven into the first responder community is a differential advantage for folks like us.”

For all these reasons, Rapid Response’s Denniston is optimistic about 2019 and beyond. “We are seeing technology finally getting to a place where false alarm reduction is going to become real. Enhancements like adding AI to the mix are keeping us on the ‘bleeding edge’ and will ensure great success in the future.”

UL’s Tallman adds,” The innovation that has been occurring over the last few years will continue through this year and beyond. The utilization of digital technology and resilient designs will result in better systems and services, and the result is a stronger industry.”

One thing is for certain: At every level the security alarm and monitoring market has seen more than its share of change recently. The good news is manufacturers, security dealers and monitoring centers are stepping up to meet the challenge. “The status quo is definitely not the order of the day, and the future looks bright, but challenging,” Spector says. “Industry disruption is all around us, and if companies want to continue with their success they better be prepared to embrace change and not shirk from it.”

SDM asked in 2017, “How would you rate the current state of the market and the potential for sales in the intrusion (burglar) alarm market?”

SDM asked in 2017, “How would you rate the current state of the market and the potential for sales in the intrusion (burglar) alarm market?”

U.S. broadband households that acquired a home security system in the past year

Park Associates asked broadband household with professional monitored security systems, "How likely would you be to switch monitoring companies if a competitor offered you the following?

SDM asked in 2017, “How would you rate the current state of the market and the potential for sales in the monitoring market?”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!