Do It Yourself or “DIY” is exploding with the arrival of Google and Apple in the connected home scene. In 2014, Google invested nearly 10 times the RMR of the entire SDM 100 — $4 billion for the acquisition of three companies, Nest, Dropcam, and Revolv — just to enter the game and promote Monitor It Yourself or “MIY” for consumers who don’t need or want a central station. Google sells “deterrence” as a security feature that bolts on to its Next and Dropcam suite of services.

This is “Alarmageddon,” a frontal assault discarding the central station from the alarm industry business model. MIY represents a unique threat, where the younger demographic concerned about personal security is willing to do it on their own with the help of new technology.

Google and Apple intend to win and the central station is not big on their roadmaps. Deterrence is now not even a commodity for sale — it’s free and in essence it assigns no value to professional monitoring.

Central stations must deliver more than deterrence to stay relevant.Police response and law enforcement partnerships are the central station’s strongest defense against MIY. While stronger police response is crucial to central station value, police want more than an absence of false alarms. Police want arrests and, ultimately, so do consumers.

Police Response: UK Lesson

If all central stations do is reduce false alarms, then they create no value and Google wins. False Alarm Reduction Methods (FARM) created by the industry are geared towards correcting user error — the overwhelming cause of false alarms. These methods include: Enhanced Call Verification (ECV), cross zoning, and two-way voice.

Metropolitan London, United Kingdom demonstrated that a FARM approach to minimize a negative was not the answer. When a growing wave of false alarms threatened to kill police response in the UK in 1994, the UK alarm industry’s answer was to support a false alarm ordinance with licensing, permits, ECV, mandatory cross zoning, and dropping response for bad offenders. From one perspective it was a success: continued police response to “legal alarms,” a dramatic reduction in total false alarms, and a significant drop in alarms calls per system occurred.

There also were unintended consequences: the value of monitoring became marginalized. Over the next decade the number of monitored alarm systems declined to only 165,000 monitored systems in a city of more than 13 million. This penetration rate is one-tenth of what we would expect in the United States, and it continues to drop 1 percent per year. For the year ended May 31, 2014, FARM produced few (17) arrests and the false alarm rate is still high at 96.6 percent. London police no longer consider central stations an important ally and have more than 600 police staff monitoring their own video cameras and sensors to protect their community. The result is many consumers in the UK have abandoned central stations and moved to MIY or unmonitored alarms with exterior sirens.

Crime in Progress Verification (CPV)

Is a verified alarm a verified user error or a verified crime? The answer paints a paradigm because reducing problems is not the same as creating value. Verifying user error does reduce total calls but has little impact on the false alarm rates, which are still 98 percent and higher in most recent studies (Toronto, Canada: 99.6 percent, Chula Vista, Calif.: 99.7 percent). Even after FARM, police typically make 50 to 100 false alarm runs to find a single burglary.

To maximize value it is crucial that central stations embrace law enforcement’s definition of Crime-in-Progress Verification (CPV) through video and impact audio verification. It is important to understand why increasing real crimes, even a few percentage points, matters to police and the best way to do this is to think of crimes per response. Consider that 99 percent false actually means that 1 percent are true. Reducing the false alarm rate 9 percentage points, from 99 percent to 90 percent, means a tenfold increase in true crimes per response. The difference is enormous to police; a solid 1,000 percent improvement. It means that instead of police going to 100 alarms to find a single burglary, there is an actual crime and potential arrest for only 10 alarm runs. Likewise, if we cut the false alarm rate roughly in half from 99 percent to 50 percent, it is not just twice as good. There are 50 times more crimes/police response and more arrests. Published police case studies have documented arrest rates of 50 percent or more (Police Chief Magazine, March 2012) with professionally monitored video-verified alarms.

Cost Per Arrest

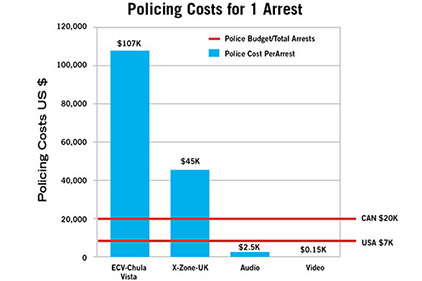

Central station-monitored verified alarms deliver value, creating a safer community for consumers and reducing the cost per arrest. For a given community responding to alarms has a cost based on officer manpower hours to respond. Jurisdictions in the U.S. and Canada report their costs per officer hour ranges from $50 to $100 and the overall U.S. average cost per arrest is about $7,000 (Justice Policy Institute, 2012, “Rethinking the Blues, How we Police in the US and at What Cost.”)

Chief Bejarano of Chula Vista, Calif., in a well-documented three-year study ending in 2012, spent $750,000 over three years responding to residential and commercial alarms and only made 7 arrests (one residential and six commercial). This averages $107,000 per arrest.

Early data shows that CPV using video or audio can reduce the cost per arrest by two orders of magnitude. (See chart on this page.) This metric is not meant to diminish the other good things police do or ignore the benefit of deterrence provided by a traditional alarm; but deterrence is free in the MIY model and cost per arrest is something that central stations can impact. Crime-in-progress verification is a force multiplier to police and delivers arrests while making central stations mission critical to law enforcement. Companies very involved in crime-in-progress verification have a cost per arrest as low as $100 to $2,500. (These companies are Kimberlite, Radius Security, and Universal Alarms.)

What’s Next?

Fierce competitors with deep pockets are buying their way into the alarm industry and attacking the value of the central station. Over the past decade, “verified-only response” by police has been seen as the threat to the central station business model. Perhaps now the opposite is true? In fact, the real threat to traditional central stations is not adapting to meet the MIY assault and deliver something more than deterrence.

Central stations offering video or audio CPV services reduce cost per arrest and already obtain priority response as valuable law enforcement partners. This differentiates more than anything else what the central station offers over MIY. n

Editor’s Note: There is an interesting whiteboard video that illustrates the concept of Crime in Progress Verification at: https://www.youtube.com/watch?v=g2vw2vGSRWc