SDM EXCLUSIVE

SDM 100: Mostly Strong, With A Focus on Video

May 6, 2024

SDM EXCLUSIVE

SDM 100: Mostly Strong, With A Focus on Video

May 6, 2024SVTEAM/CREATAS VIDEO+ / GETTY IMAGES PLUS VIA GETTY IMAGES

Looking at this year’s SDM 100 report you might be tempted to think that the majority of the top 100 security dealers had a fantastic, boom year in 2023. And as an aggregate, they did. Numbers were up across the board, with total RMR increasing 7 percentage points over last year, to $714 million, the highest number since 2016. Total annual revenue increased 8 percentage points to its second highest amount in a decade, also behind 2016. Residential and non-residential sales revenues increased by 33 and 10 percentage points, respectively. Profits were also up by 6 percentage points. Even total annual subscribers, which had been slowly declining over the past several years, bumped up by 2 percentage points.

But these numbers, as good as they are, don’t show the whole picture. While a healthy number of those who added comments to their surveys indicated 2023 was strong, many others described it as average, or even declining, particularly in light of higher interest rates and inflation in 2023. Yet, most of these companies posted increased profits and RMR even if they indicated it was a weaker overall year. How did they do it?

On the positive side, the vast majority of those who commented noted that the supply chain issues of 2021 and 2022 have largely resolved, which definitely helped business in 2023.

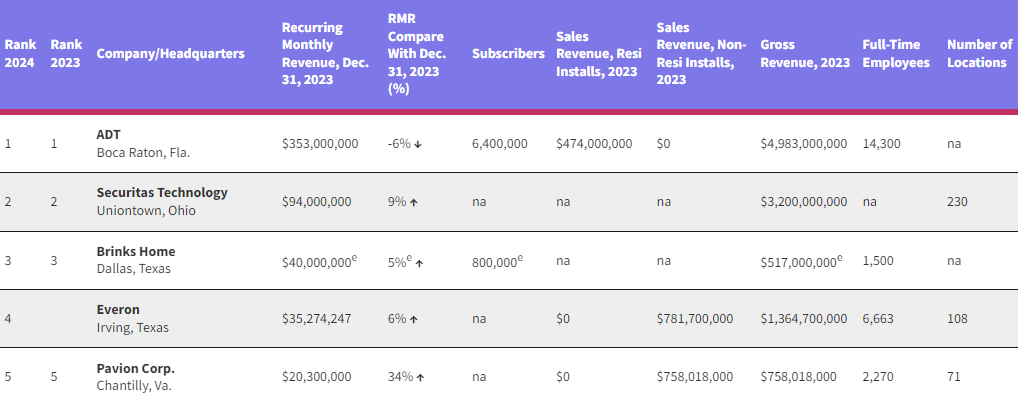

2024 SDM 100 Preview

No. 39, Minuteman Security and Life Safety, wrote: “The market in 2023 was very strong. ... Our sales were up across the board. We noticed a particularly strong increase in healthcare and higher education. Supply chain issues were greatly improved from the previous year or two and didn’t have an impact on our business.”

No. 7, Bay Alarm, wrote: “Compared to 2022, the market in 2023 was weak. 2023 saw a significant improvement in supply chain issues over 2021 and 2022.”

No. 19, American Alarm & Communications, noted: “Overall the market was average. … Supply chain issues were not a factor in 2023 but inflation was still an issue, as were higher interest rates.”

But while supply chain issues were notably improved, over and over again, companies brought up another issue that has far from resolved: ongoing labor shortages.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

“Overall, the market in 2023 was about the same as 2022,” wrote No. 46, Valley Alarm. “The market was very weak in Q1, but rebounded in Q2 and remained solid for the rest of the year. CCTV and proactive video monitoring were the strongest. Fire was the weakest. There were minimal supply chain issues in 2023. However, technical labor shortages and inflation (particularly labor) hurt revenues and margins.”

No. 63, Guardian Hawk Security, wrote: “The 2023 market was stronger than 2022. As the supply chain issues of post-COVID life eased, we found an uptick in security spending across the board, even through rising inflation. Labor force shortages became the more difficult focus and rising employment costs for talent.”

SDM 100: 5-Year Snapshot

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

SDM 100 RMR UP 7 Percent to $714 Million

Total SDM 100 recurring monthly revenue (based on 12/31 in $ millions)

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Total Annual Revenue: $16.3 Billion

Total SDM 100 Annual Revenue ($ billions)

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Majority of Dealers Say 2024 Revenue Will Be Up

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

PRODUCT Category Segments

Average percentage of total revenue among SDM 100 companies, distributed by types of products/technology

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

SERVICE Category Segments

Average percentage of total revenue among SDM 100 companies, distributed by types of services

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Installation & Tech Service Top Opportunities at SDM 100 Companies

Average percentage of staff employed in various departments at SDM 100 companies

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Profits Increased In 2023

SDM 100 companies were asked, “Did your company’s net profit margin increase, decrease or stay about the same in 2023 compared with 2022?”

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

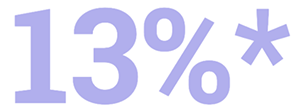

SDM 100 Average Net Profit Margin

SDM 100 companies were asked, “What was your company’s net profit margin in 2023?”

Average net profit margin among SDM 100 companies:*

*average percentage, based on 70 responses

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

SDM 100 Dealers Gained 8 Percent Subscribers in 2023

Percentage of subscribers gained or lost in each of the following years:

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Over 9,500 Security Vehicles in Use in 2023

Number of vehicles used by SDM 100 companies

// SOURCE: 2024 SDM 100, SDM MAGAZINE, MAY 2024

Some companies that reported a very strong year seemed surprised by it.

“The market in our area was stronger than expected,” wrote No. 66, Moon Security Services Inc. “For the first time in our history, we had two sales staff exceed $2 million in sales, and a third just missed at $1.98 million. Multi-family dwellings led the way, but all lines — fire, access, cameras, video intercom, and security were up across the board.”

No. 55, Fleenor Security Systems, wrote: “Thankfully, we had another fantastic year in 2023. The security market remained strong for the entire year and this was a huge surprise to us all. In 2022 we predicted there would be a slowdown mid-2023 because we thought the economy would finally stall out, but it never did. Historically, when interest rates increase and borrowing money gets expensive, commercial projects slow down; but this did not happen in 2023. We also benefitted on the residential side because of the large influx of people moving to our area and kept a low attrition rate due to locals staying in their homes longer.”

However, even for those who described the market as less than “strong,” this group of successful security dealers — just as they have in past years both good and bad — also made active choices that helped their bottom line numbers.

“The market in 2023 slowed significantly,” wrote No. 57, Titan Alarm Inc. “It took a lot more work to get the jobs we were bidding on because consumers stopped growing and expanding because the economic outlook was uncertain. It bounced back after Q1 a bit, but then tightened up again towards the middle/end of the year. I would still not describe it as a weak market, but I wouldn’t go so far as to describe it as strong. I would say that it was waning. … We significantly cut expenses and still increased in revenue, and increased profits by almost $1 million.”

No. 64, LOUD Security Systems Inc., was another company that reported a slowing trend, writing: “2023 has definitely started showing a much slower trend in security and integration when compared with 2022, although there has been a much higher demand for integrated systems. While overall demand is slowing, demand for systems with integrated video services are on the rise as a percentage of systems sold. … LOUD Security has successfully folded new video services and proactive video monitoring into its line of services and is beginning to push heavily into the video integrated market.”

They were hardly alone. No. 53., Owen Security Solutions Inc. summed up succinctly what many commenters wrote about throughout: “The market in 2023 was strong with an emphasis on cameras.”

For many of the companies on the 2024 SDM 100, 2023 was a mixed year of both challenges and opportunities; some roadblocks easing and others coming to take their place. Inflation, high interest rates, and labor shortages were tough obstacles, but they were helped by a increasing level of interest in security technologies — particularly video — rising crime that motivated customers to buy these technologies, and the staving off of the predicted recession.

Read on to hear more of what this year’s top companies had to say about the residential and commercial markets, challenges and opportunities, as well as their predictions for this year.

The U.S. military and intelligence communities spend huge amounts of effort and money on obtaining and analyzing imagery. The ability to see threats in detail, over time, and in context is invaluable. Satellites and aerial reconnaissance systems have been around for a long time; but it is only with recent advancements in technology and techniques, and their declining costs, that the overall usefulness and demand has surged.

This is true for the use of imagery in the security industry as well. Who doesn’t want high-definition, full motion video, in real time and digitally stored, when evaluating crime or loss related incidents? For most situations, it can provide the most accurate and information dense data for making decisions and taking action.

Prior Issues & Recent Developments

The largest obstacles to broad use of imagery (video) based systems have historically been the cost and capability of cameras, communication bandwidth, and information storage. Each of these have been tackled, and are generally much, much faster, better, and cheaper — with more room to go. The largest remaining challenge has been a data sifting issue. Every minute of imagery coming from modern-day cameras is a huge data set, with most of it being irrelevant to matters of security. The problem has been separating out the security-related data, and doing it accurately, very quickly, and inexpensively. Having humans staring at individual cameras 24/7 is cost prohibitive, and not a very accurate or reliable solution.

A highly capable computer-based imagery sifting ability that can separate the desired intelligence from the “noise” is needed. While much like the other previously inhibiting factors, there has been some capability in this area for a fair amount of time, the performance and costs were generally not to the required levels to spur a large surge in demand. It appears this has changed with the recent advancements in AI/Machine Learning.

A Compelling Example

At our annual conference we devoted a fair amount of the agenda to this topic. One of the presenters at our event was Elite Interactive Solutions, ranked No. 31 on the SDM 100. They are a specialist in the use of video-based systems for security and have harnessed these new developments. This is shown in a couple of numbers they disclosed.

First, in the year 2023 they had 102 million hours of high-definition video imagery come into their command center from their customer base. Their AI-driven analytics system sifted through 99.946 percent without requiring operator interaction. That is, the command center had to staff only 55,000 hours to handle the critical security related incidents. This is an astounding 1,845:1 technology enabled leverage (i.e. only 1 hour of staffing per 1,845 hours of imagery). Secondly, out of the system selected hours requiring interaction, 73,000 incidents were handled (most fully mitigated), and resulted in over 1,000 arrests. Most importantly, fewer than a handful of incidents were missed (pointing to six sigma level accuracy potential) and zero false alarms. Zero! By any standard, this is impressive.

Lastly, Elite shared what they charged their customers for this 102 million hours of imagery monitoring, analysis, and highly effective processing. Wait for it: $0.14 per hour. That is what they charge, not their costs!

Big Opportunity

These results point to a very big opportunity for the security industry. While a portion of this type of service appears to be replacing manned guards or traditional security alarm systems, often times it is supplementing them. Either way, this level of capability at these cost levels will be good for the industry and good for the end users, and this is just the tip of the iceberg.

Some Caveats

Elite pointed out that their level of effectiveness and cost efficiency is highly dependent on the application, the onsite configuration, and a host of other specific components of the overall package. This is an important note. You can’t assume that this applies to all applications, systems, and services. The consensus among the experts at our conference was that the biggest mistake typically made is committing to doing something without truly understanding the accuracy potential and the associated cost. This points to the industry advancing along defined service offerings and applications, and then broadening over time and extended experimentation. This is generally good in that the industry’s fragmented structure may facilitate this with potentially hundreds or thousands of companies performing some level of experimentation. On the other hand, it requires capability and technological savvy at a level that only a few may possess. Time will tell.

It is also not clear whether the end users will generally seek this capability on a standalone basis, from dedicated experts, or push to have this integrated into traditional offerings. Nor is it well documented yet what level of synergies there are when these offerings are embedded in traditional alarm/integration businesses, or for that matter manned guarding companies. At this point, most of the state-of-the-art is being done by specialists.

Get At It

While it is not yet clear how this unfolds, there is no doubt that it will — and in a big way. You can see it coming. Now is the time to look ahead and formulate your strategy for staying competitive within this new reality.

Michael Barnes is the President of Barnes Associates, Inc. a brokerage, advisory, and consulting firm that specializes in the security alarm industry.

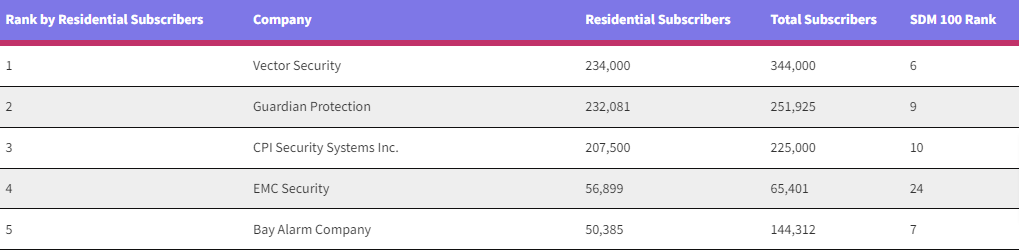

Top Companies Ranked by Residential Subscribers Preview

Residential & Commercial Experiences

Of the top 100 companies, about 62 percent of them sell residential systems, 77 percent commercial, and 60 percent sell both.

No. 9, Guardian Protection, wrote comprehensively about both sides of the market. “The residential field [existing homes] segment had the least amount of new customer growth but drove revenue growth from additional services such as home automation and video devices and services,” wrote April Maloney, vice president of residential sales. “These services are complementary to our core monitored security business and increase our customer engagement. Guardian’s biggest opportunity for growth is in our builder/new construction segment. Although the growth opportunity in the segment has slowed due to higher interest rates, the inventory of existing homes remains low, which has driven buyers to new construction as an alternative. … Given that Guardian Protection’s business model is based upon professional installation and monitoring, the entrance of DIY/do-it-together companies continues to cause disruption in our space. However, we believe professional installation is a differentiator that will continue to be desired by a significant portion of the market.”

On the commercial side, Kevin Santelli, vice president, commercial and national accounts, wrote: “In its Commercial and National Account Business Units, Guardian experienced growth in most verticals in 2023. These employers continue seeking new ways to efficiently manage multi-site locations and overcome labor shortages as evidenced by their ongoing investments into AI and cloud-based systems. Supply chain issues in 2023 had much less of an impact on our day-to-day business than in 2022.”

Rank by Total Annual Revenue Preview

On the residential side, No. 72, Dehart Alarm Systems LLC, noted funding was off a little, due to inflation and interest costs reducing discretionary funds.

Others echoed this sentiment.

“The depressed housing market caused a reduction in new opportunities,” wrote No. 95, JM Resources Holdings LLC.

Although No. 89, Atlantic Security & Fire, did note that its residential security sales actually increased due to excessive residential auto and home break-ins in their state.

On the commercial side, many companies noted the rise in demand for integration, particularly utilizing camera AI, analytics, video and cloud.

Dehart Alarm Systems LLC, wrote of its commercial business: “We saw an increase of commercial integrated projects in the 4th quarter of 2023. Security systems remained the same year over year. The camera and access systems markets were stronger in the commercial market and remained the same in 2023. … We moved our monitoring database to a hosted environment which has allowed us to recognize greater business continuity, redundancy, disaster preparedness and a host of services we could not offer our customers before. We increased our commercial sales and commercial integrated sales and look forward to an increase in the commercial market in 2024.”

No. 98, 2 Krew Security & Surveillance, wrote: “Integrated systems sales in our market increased substantially over 2023. We saw a lot of growth in the manufacturing and education verticals. There is an increase expectation for multisystem integrations that allow for an easier end-user experience. The demand for this single pane of glass is anticipated to only increase in the future.”

Challenges & Opportunities

Top security dealers faced their share of challenges in 2023. High interest rates and inflation were definitely pain points, but some companies turned it into an opportunity, raising rates and increasing revenue as a result.

“Inflation had a big impact in 2023,” wrote No. 75, Security Alarm Corporation. “We saw significant increases in both equipment costs and labor costs. For the past three years we have averaged a 15 percent per year increase in labor costs. This has resulted in increases in our RMR, installation rates and service rates.”

No. 37, Peak Alarm Co. Inc., SDM’s 2023 Dealer of the Year, wrote: “Inflation worked in our favor as we increased our prices for install and monitoring at or above inflation levels.”

But far and away the greatest challenge mentioned by a large majority of commenters was the issue of the labor shortage — both as a challenge in 2023 and a concern for 2024.

“Our biggest challenge to grow will continue to be finding, attracting, and developing skilled labor to install and service our systems,” wrote No. 15, Zeus Fire and Security LLC. “We’re pursuing all available avenues to recruit and partnering with organizations that promote careers in the trades to help build the pipeline for the future.”

No. 99, Northeast Security Solutions Inc., wrote: “We experienced strong demand for our services in 2023. Access to qualified sales and technical staff members limited our ability to respond to that demand more than any product disruptions. Technical labor costs grew to ensure existing staff wasn’t enticed by competitor recruiting efforts.”

No. 47, Beacon Protection, echoed that sentiment: “The ability to continue to hire new talent for our sales and installation teams has been a major challenge to our organization.”

No. 16, Per Mar Security Services, noted: “Our success will continue to be dictated by our ability to find and retain great people.”

The integration and video themes were also brought up over many comments, mostly about the commercial side of the market, but also some residential.

No. 67, Custom Alarm, wrote: “In regards to opportunities, video monitoring is the biggest opportunity for us as more and more businesses and even homeowners are better understanding the value and benefit of video and video monitoring. Not only are insurance companies requiring it on some construction sites, but there is more adoption to this type of video and it truly solves a problem both in a business and around it. It is a great revenue stream and provides for ongoing interaction with our customers creating stickier customers as they trust us on their home and business security needs.”

Zeus added: “Buyers in most commercial verticals are willing to pay a premium for systems that are well designed to meet their needs. We saw the fastest growth in video surveillance and access control systems. Advancements in video technology and monitoring center capabilities are allowing us to serve more facility types and use cases than in the past. Customers are also demanding more fully integrated systems which has led to strong growth in access control across our network. Intrusion alarm systems were our slowest growing segment as many of our target customers move to video-based or more integrated systems and as the technology becomes more commoditized.”

For more comments on these technologies and their impact see the sidebar, “Video, Remote Monitoring & AI Top the Tech Trends.”

This year’s top security dealers had a lot to say about new technology — particularly related to video, remote video monitoring and AI. Here are a few of their comments:

No. 9, Guardian Protection: AI and machine learning will continue to revolutionize the security industry, enhancing capabilities in surveillance, threat detection, and response. AI can improve the efficiency and accuracy of security systems but also raises ethical and privacy concerns that businesses must address.

No. 12, Stealth Monitoring: Artificial intelligence and machine learning are driving new camera adoption to adopt new technologies that will enable a better monitoring performance. The need and desire to save operational expenses by replacing guards with lower-cost alternatives as companies look to become more cost-effective within the current economic conditions.

No. 15, Zeus Fire and Security LLC: We continue to invest in use cases for advanced analytics and artificial intelligence, particularly related to video systems. Many of our customers are seeking support for operational challenges where insights from live video can improve efficiency or enhance controls. We expect this will unlock new markets, way of engaging with our customers, and future revenue streams.

No. 46, Valley Alarm: Proactive video monitoring will continue to be a big growth sector driven by improved analytics and AI.

No. 64, LOUD Security Systems Inc.: Moving into 2024, we predict that video will continue to play an even larger role in security system sales, and will become not just a desire, but a demanded and necessary component. AI will also begin to take a more consumer-facing position in video and detection, hopefully allowing for greater accuracy of alarms, which will be more trusted by both consumers and first responders.

No. 67, Custom Alarm: [Another] thing we think is making the biggest impact is AI — how to leverage it and when to use it and when not to use and how to learn how to optimize it and incorporate it into our work both in the office and out on job sites. We are in the early stages of learning about it and have a steep learning curve [for] how we can educate our staff on it as well as where are areas that we can leverage AI in place of some human functions creating more efficiencies in our business.

No. 69, Frase Protection: I think crime will continue to rise. We will push deeper into verified video services for our customers.

No. 98, 2 Krew Security & Surveillance: We believe AI will become more of a dominate player in the video and access control markets to enable better real time processing of information. Considering the current world events, we believe generally speaking most commercial facilities will show an increase in need for security to protect property and assets. With crime increasing, the need for security will continue to be in demand.

What’s Coming This Year?

So what issues are on the minds of the top 100 security dealers for 2024? Mostly that ongoing labor problem, the economy and the coming election.

Inflation is expected to improve, but no one knows at what rate.

Peak Alarm Co. Inc. wrote: “We feel 2024 is going to be determined by inflation, or to be more specific the Federal Reserve’s actions towards inflation. If interest rates hold steady or better yet start to come down we will see an increase in capital and a corresponding increase in sales. If inflation is stubborn and we see interest rate hikes, the economy will slow to a crawl and companies will be reluctant to spend on capital expenses.”

Writing on the economy in 2024, Guardian Protection noted: “The decline in new home buying (both existing and new construction) due to low inventory, high interest rates, and skyrocketing prices will have an impact on the number of opportunities we have to sell our residential products and services. An uncertain economy can also affect client budgets within the commercial sector, potentially impacting discretionary spending for security projects.”

The upcoming election is also creating some uncertainty.

No. 36, Custom Security Systems Inc., wrote: “Presidential election years sometimes create a general uneasiness that can reduce consumer spending for the short term.”

No. 33, Sonitrol of Sacramento & Orange County, Cybex Security Solutions, elaborated more on this concern: “As we come into an election year in 2024 we feel the economy and the political climate could cause companies to delay spending.”

When it comes to the labor issues, that in some ways is the biggest concern for many companies.

No. 99, Northeast Security Solutions Inc., wrote: “The biggest concern I have pertains to access to qualified labor. Many industries are struggling to find good help but we have the additional complication of being a licensed trade. Electricians are retiring faster than the pace of apprentices getting licensed. I see this problem getting worse before it gets better.”

No 55, Fleenor Security Systems, also wrote a cautionary tale: “As an industry, and on the local level, we must continue to invest in training programs in order to recruit and train qualified technicians. Growth will be much slower for us all if we cannot fill the open positions with competent technical staff.”

Still, no matter what happens, many security dealers look to the positives in the industry, particularly on the new technology front.

No. 50, Prosegur Security Integration, summed up the philosophy that seems to be shared by many: “The security industry is on the cusp of a dynamic transformation, with technology, integration, and adaptability at its core. We are committed to staying at the forefront of these developments, leveraging innovation to provide our clients with the highest level of security services and support. Our goal is to continuously evolve to meet the evolving needs and challenges of the modern security landscape.”

Objective of the SDM 100

The SDM 100 has been published since 1991. Its primary objective is to measure consumer dollars gained by security companies, in order to present an account of the size of the market captured by the 100 largest providers. SDM 100 companies are ranked by their recurring monthly revenue. RMR is the revenue associated with the contractual agreement between a security company and its subscriber — derived from customer billing for services such as monitoring, contracted service/system maintenance, security-as-a-service and managed/cloud solutions, and leasing of security systems — and is typically the basis for valuation of a security company. RMR is the language of security company executives and is meaningful in comparative analysis among industry peers. Of the 100 security dealers ranked, 34 of them earned more than $1 million in RMR in 2023.

How to Purchase the SDM 100 Directory

Wouldn’t it be useful to have more information about each of the 100 companies ranked here? The 2024 SDM 100 Directory includes contact names, mailing addresses, telephone numbers, website URLs, branch office locations, product buyer names, installation data, and more. The SDM 100 Directory comes in Microsoft Excel format. To order, contact Jackie Bean at 215-939-8967 or by e-mail to beanj@bnpmedia.com.