Articles by Laura Stepanek

Video Surveillance

The learning curve with surveillance drones, security robots and counter-drone solutions is less about absorbing new technology and more about executing it for the best results in the appropriate use-cases.

Read More

SMART HOME/BUSINESS

5+ Ways to Increase Revenue With Interactive Services

As customers add more products to their interactive systems, the security dealer’s RMR climbs.

April 22, 2021

VIDEO SOLUTIONS

Integrators’ Experiences With EST Detectors

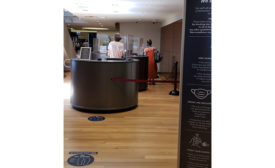

Security integrators share what they’ve learned about thermal cameras designed for elevated skin temperature detection.

January 18, 2021

INTEGRATION & NETWORK SOLUTIONS

Security Appliances: What They Do & How to Select Them

As appliances have added functionality to appeal to the enterprise market, they are moving farther afield from their roots as embedded, dedicated devices. Security integrators must stay on top of their evolution.

November 23, 2020

VIDEO SOLUTIONS

Taking the Temperature of Thermal Cameras

In the effort to reopen business, thermal cameras have a role to play, but security integrators need to educate themselves on what they can and cannot do.

July 9, 2020

SDM EXCLUSIVE

SDM 100 Brand Report: The Most Popular Brands Among the SDM 100 Companies

Which suppliers do the largest security dealers use? This SDM 100 brand-usage report details the manufacturers and distributors that earn their business.

June 8, 2020

SDM EXCLUSIVE

2020 SDM 100 Report: After Peak Performance, What’s Next?

The excellent growth SDM 100 companies had in 2019, followed by the onset of the coronavirus pandemic, is like being on the summit without a clear view of the landscape. Dealers are looking to their RMR to carry them through.

May 11, 2020

Editor’s Angle

It Isn't About You Anymore; It's About Hiring More People Totally Unlike You

March 2, 2020

Be in the forefront of security intelligence when you receive SDM.

Join over 10,000+ professionals when you subscribe today.

SIGN UP TODAY!Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing